My Husband Spent Our Family Savings on a Car and a Trip to Paris for His Mother — So I Taught Him a Lesson He’ll Never Forget

The Paris Betrayal: How My Husband Spent Our Savings and I Forced Us to Rebuild

We had been saving for three years to buy a new car.

Three long, arduous years of pinching every penny, skipping the vacations, and saying the quiet, familiar “maybe next time” to every small indulgence. With three young kids under the age of ten and a van that coughed and sputtered every morning like a smoker on their last breath, a reliable car wasn’t a luxury; it was a non-negotiable necessity.

My husband, Paul, had always seemed completely on board. He was the one who started the savings spreadsheet, who made a big show of checking our balance monthly, and who would cheerily announce, “Just a little more, and we’ll get there.”

I trusted him completely.

Or at least I did, until that Wednesday evening.

The Guilty Grin

I had just finished tucking the kids into bed when Paul walked into the bedroom, wearing a grin that instantly put me on high alert. It was the familiar expression—a mix of excitement and guilt, the same one he wore when he’d “accidentally” bought a new, expensive gadget we didn’t need.

“I did something today,” he announced.

“Oh?” I said slowly, folding the laundry on the bed. “Should I be worried?”

He laughed, a nervous, high-pitched sound. “No, no. You’ll love it. I bought a trip to Paris for Mom!”

I froze, a clean towel suspended halfway to the basket. “You did what?”

He puffed out his chest. “A trip to Paris! You know she’s always dreamed of going. Her friend Barbara just went last month, and I thought, Why not surprise her?”

I stared at him, waiting for the obvious punchline that never came. “Paul, please tell me you didn’t use our car savings.”

His grin finally faltered. “Well… I mean, technically, yes. But think about it—Mom deserves this. She’s done so much for us.”

My stomach bottomed out. “You used the car fund? The one we’ve sacrificed three years for?”

“It’s still for a car,” he said quickly, rushing to defend himself. “I also put a down payment on a new one today! I found a great deal—zero percent interest for the first six months.”

My jaw locked. “Wait. You bought your mother a trip and a car down payment? With our joint savings?”

He nodded enthusiastically, expecting a hug. “Isn’t that great? Now we have a new car, and Mom finally gets her dream trip! It’s a win-win!”

I just stared, completely speechless.

That “car fund” wasn’t just digits on a screen; it was tangible evidence of months of personal sacrifices. It was me cooking at home every night, mendings the kids’ clothes by hand, saying no to every simple pleasure, and forcing myself to skip a needed haircut. It was the quiet denial of every small want so that we could satisfy one urgent need.

“Paul,” I managed, my voice dangerously even, “how much did you spend?”

He fidgeted. “The Paris trip was around five thousand. And the car—just the down payment—was another six.”

“Eleven thousand dollars?” I said, my voice finally escaping its constraint. “You spent eleven thousand dollars without talking to me?”

He looked genuinely offended. “It’s our money, Laura. I didn’t think I needed permission. You know how much Mom’s done for us. She deserves something nice before she gets too old to travel.”

“And what about our children?” I shot back. “What about when the van finally dies, which it will? Are we supposed to take the bus to the grocery store while your mother sips espresso under the Eiffel Tower? That money was for our family’s security!”

His face flushed defensively. “That’s not fair. You’ve never liked my mom. This isn’t about money—it’s about you being jealous.”

“Jealous?” I laughed bitterly. “Paul, I’m not jealous of your mother. I’m furious because you prioritized fixing your guilt over your mother’s past sacrifices instead of fixing our family’s future security. You didn’t even discuss it with me.”

He crossed his arms, muttering the ultimate betrayal: “You wouldn’t have agreed anyway.”

“That is precisely the point!” I snapped. “We are supposed to make these decisions together.”

The Harsh Reality

The argument devolved until midnight. I lay awake, the full weight of his impulsive betrayal settling on me. I realized yelling wouldn’t work; he needed to understand the real-world consequences of his actions.

I decided to teach him a lesson—not through fighting, but through reality.

I left the electric bill unpaid. Our grocery list grew shorter, excluding all but the essentials. I canceled our streaming subscriptions.

“Mom, why can’t we watch our show?” our oldest, Grace, asked one evening.

I forced a smile. “Because Daddy used our money for something special, sweetie. So now we have to save again.”

Paul frowned. “Don’t drag the kids into this, Laura.”

“I’m not dragging them in,” I replied calmly. “I’m just being transparent. That’s what partners do. We’re currently operating on an emergency budget.”

He rolled his eyes. “You’re being dramatic. We’re fine. I’ll get a bonus soon, and everything will even out.”

But the universe, apparently, was on my side.

Two weeks later, the van finally surrendered. The engine died on the way home from the grocery store, and I sat in the rain with the kids for over an hour waiting for a tow truck. When I called Paul, his first words were the exact, selfish response I expected: “Can’t you just take Mom’s car for a while?”

“Your mom is in Paris, remember?” I said flatly. “She’s busy taking selfies at the Louvre.”

The silence on the other end was satisfying.

The next few days were chaos: me begging rides, Paul using the new car he’d bought for his work commute because, naturally, he “needed it more during the day.”

This was the final straw.

The Non-Negotiable Workshop

Saturday morning, I called a family meeting over pancakes. Paul came downstairs yawning, still expecting a lecture.

“What’s going on?” he asked.

I smiled sweetly. “Nothing big. I just thought we should talk about finances—since you seem to think we’re doing so great.”

He groaned. “Laura, please—”

“No, listen,” I interrupted, my eyes locking on his. “You spent eleven thousand dollars without consulting me. So I thought I’d do the same.”

His eyes narrowed suspiciously. “What are you talking about?”

I slid a piece of paper across the table—a printed listing for a “Financial Literacy Workshop for Couples.”

“I signed us up,” I said cheerfully. “Two hundred dollars. Non-refundable. It starts next weekend.”

He stared at the paper. “You’re kidding me.”

“Nope. Three full days of budgeting, communication, and joint decision-making at the community center. I figured it’s time we both learned how to actually manage money as a team, since we clearly missed that part of the marriage vows.”

When the confirmation email hit his inbox later that day, his smile finally vanished for good.

The workshop turned out to be exactly the forced intervention we needed. The first session required couples to write down and share their biggest financial mistake.

I wrote: Letting my husband handle our savings without accountability.

Paul wrote: Buying my mom a trip before making sure my family was secure.

He looked genuinely sheepish as he read his aloud. For the first time since the revelation, I saw authentic regret—not just embarrassment—in his eyes.

Later, the instructor asked, “If you lost your entire savings tomorrow, what would you do differently?”

I didn’t even have to think. “Talk to each other before spending a cent.”

Paul nodded beside me, his voice quiet. “Same. I didn’t realize how much pressure I put on her until now. I made her feel disposable.”

It was agonizing to hear and say those things out loud, but the forced transparency cracked the wall between us. We stopped talking at each other and started talking to each other.

Rebuilding the Partnership

When the workshop ended, we sat in the car in silence. Paul finally sighed. “I messed up. I thought I was doing something good, something generous. I didn’t realize how selfish it looked to you.”

“I know you meant well,” I said, softened by his honesty. “But you can’t fix guilt by spending money. You just transferred the burden of instability onto me.”

He reached over and took my hand. “I’m sorry, Laura. I’ll make it right.”

Over the next few months, Paul followed through. He sold some of his expensive gadgets, picked up extra shifts, and redirected his entire next bonus into rebuilding our savings. He also traded the new, zero-interest car for a practical, used model with lower payments that we both agreed upon.

When his mother returned from Paris, she actually pulled me aside.

“Laura, I loved the trip,” she said sincerely. “But Paul told me it was a surprise, and I felt awful. If I’d known it came from your family car fund, I never would’ve gone.”

She squeezed my hand. “You’ve been patient with him. He’s always had a big heart, but you’re the one with the good judgment. You’re good for him.”

It was the first truly honest, tension-free conversation we’d ever had.

By the end of that year, our savings account had recovered, and this time, it was managed with a proper, jointly agreed-upon budget.

One evening, Paul came into the kitchen holding an envelope.

“What’s that?” I asked.

He smiled sheepishly. Inside was a reservation for a weekend cabin by the lake, prepaid.

“It’s prepaid,” he said quickly. “And before you ask—I used my side project money, not our joint account. I just thought we could use a break. Together.”

I laughed, a real, full laugh. “You actually budgeted for it?”

He grinned. “Every penny.”

That weekend was restorative. Watching Paul teach our youngest how to fish, I realized the full extent of the change. His mistake had hurt us, yes, but it had also forced us to rebuild our partnership—stronger, more honest, and more connected than before.

When we got home, I saw a note taped to the refrigerator door, written in Paul’s handwriting:

Rule #1: Talk first, spend later.

Rule #2: No surprises—unless it’s cake.

Rule #3: We’re a team. Always.

I smiled, shaking my head. He had finally learned his lesson. And I learned that the best financial decision in a marriage isn't about how much money you save, but how much trust you build along the way.

News in the same category

My husband called me poor in front of the guests, but he didn’t know something.

Your parents won’t be attending the wedding,” said the future mother-in-law to the bride.

Your wife stole my necklace!” – Mother-in-law shouted. “She’s a thief! I’ll have her locked up!

My salary is spent by me, Elena Viktorovna, and your son has a separate budget!” – the daughter-in-law retorted to her mother-in-law.

— They’re not my children,” screeched the aghast husband. “Lada, they’re… dark-skinned! Who did you pick them up from?

Decided to seduce the second son, too?” the mother-in-law screamed (upon discovering her daughter-in-law’s high-heeled shoes).

— So, sweetie, you’ll sell the summer house, give me the money, and I’ll pay off your husband’s debt, declared the mother-in-law as she looked at her daughter-in-law.

Having learned from the doctor that her mother-in-law’s discharge had been postponed for a week, the wealthy man’s wife sensed something was amiss and pleaded with the nurse to keep an eye on her husband…

Pack your things and get out!” declared Timur to his wife, though he had overlooked one detail

A Heartbreaking Goodbye: Remembering Beeper’s Final Journey

A Mother’s Battle: Fighting Cancer With a Newborn in Her Arms

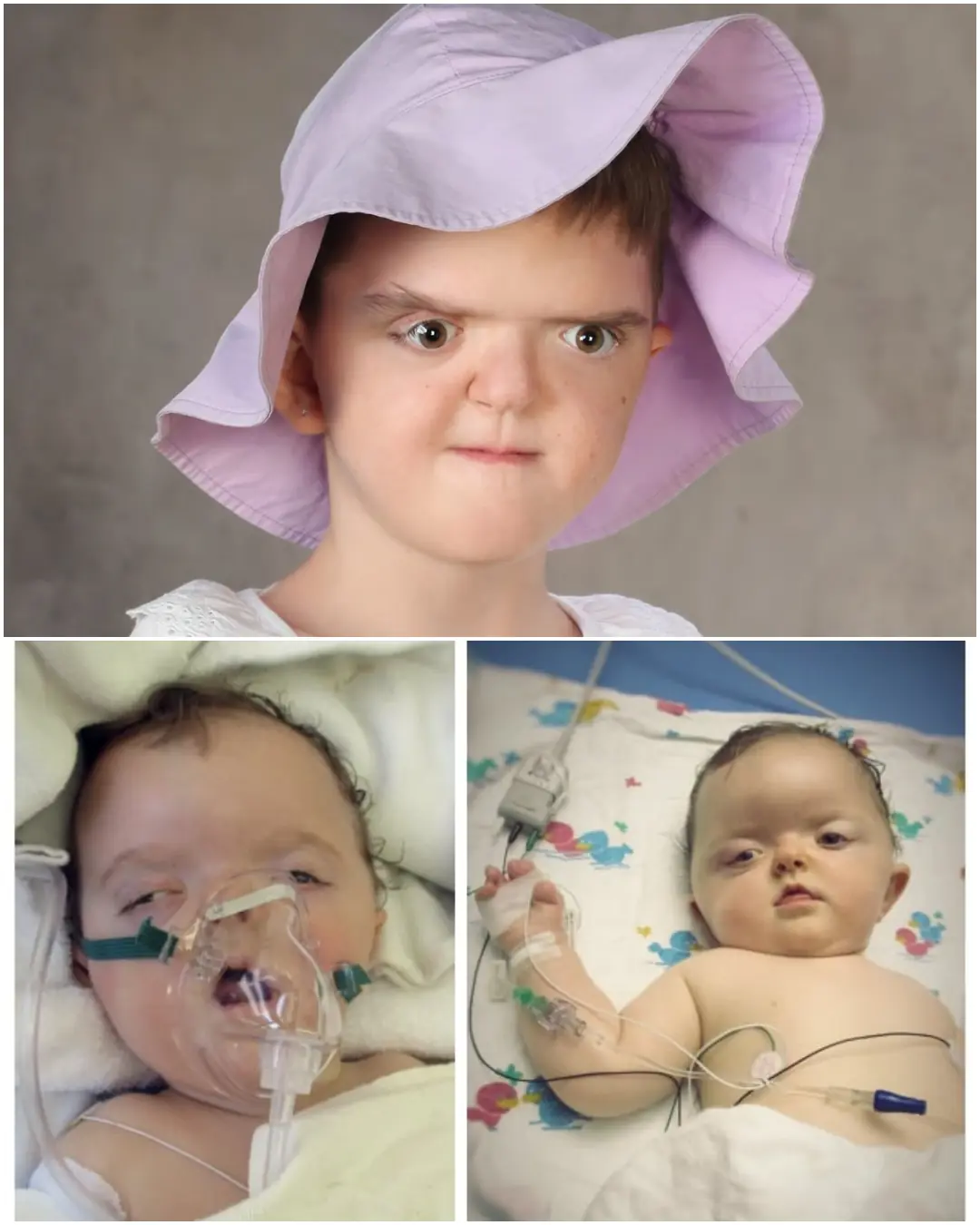

A Life on Borrowed Time: Karolinka’s Fight Against Apert Syndrome

My Neighbor Spread Rumors That My Son Was Rude and Ill-Mannered — I Refused to Stay Silent and Put Her in Her Place

My Husband’s Adult Children Showed Up on Our Honeymoon Demanding Our Villa — They Ended Up Learning a Lesson in Respect

My Neighbor Egged My Car for Blocking His Halloween Display — I Made Sure He Paid and Never Messed With Me Again

My ex left his estate to me instead of his wife and kids – His reasons left me stunned

I Adopted a Baby Left at the Fire Station – 5 Years Later, a Woman Knocked on My Door & Said, ‘You Have to Give My Child Back’

I Took My Grandma to Prom Because She Never Got to Go – But My Stepmom’s Cruel Plan Left Her in Tears

News Post

Clear the apartment, I am the new wife of your husband, I will live here!” — a woman grinned and announced to me on the doorstep.

My husband called me poor in front of the guests, but he didn’t know something.

Your parents won’t be attending the wedding,” said the future mother-in-law to the bride.

Your wife stole my necklace!” – Mother-in-law shouted. “She’s a thief! I’ll have her locked up!

My salary is spent by me, Elena Viktorovna, and your son has a separate budget!” – the daughter-in-law retorted to her mother-in-law.

— They’re not my children,” screeched the aghast husband. “Lada, they’re… dark-skinned! Who did you pick them up from?

Decided to seduce the second son, too?” the mother-in-law screamed (upon discovering her daughter-in-law’s high-heeled shoes).

— So, sweetie, you’ll sell the summer house, give me the money, and I’ll pay off your husband’s debt, declared the mother-in-law as she looked at her daughter-in-law.

Having learned from the doctor that her mother-in-law’s discharge had been postponed for a week, the wealthy man’s wife sensed something was amiss and pleaded with the nurse to keep an eye on her husband…

Pack your things and get out!” declared Timur to his wife, though he had overlooked one detail

A Heartbreaking Goodbye: Remembering Beeper’s Final Journey

A Mother’s Battle: Fighting Cancer With a Newborn in Her Arms

A Life on Borrowed Time: Karolinka’s Fight Against Apert Syndrome

My Neighbor Spread Rumors That My Son Was Rude and Ill-Mannered — I Refused to Stay Silent and Put Her in Her Place

My Husband’s Adult Children Showed Up on Our Honeymoon Demanding Our Villa — They Ended Up Learning a Lesson in Respect

My Neighbor Egged My Car for Blocking His Halloween Display — I Made Sure He Paid and Never Messed With Me Again

My ex left his estate to me instead of his wife and kids – His reasons left me stunned

I Adopted a Baby Left at the Fire Station – 5 Years Later, a Woman Knocked on My Door & Said, ‘You Have to Give My Child Back’