Princeton Just Changed Higher Education Forever: Families Earning Under $250K Won’t Pay a Single Dollar in Tuition

Princeton Just Shook Up Higher Education—But There’s More Behind the Move Than Meets the Eye

An Ivy League giant just made a decision that could transform how Americans think about college access and affordability. But while the headlines celebrate generosity, the timing suggests a far more complex story.

For decades, elite universities have guarded their exclusivity like dragons hoarding gold—keeping admission rates in the single digits and pushing annual costs to levels that eclipse most families’ savings. A single year at a top-tier school now tops $90,000. Even middle-class households earning what once counted as financial stability are finding themselves shut out—too “rich” for aid, too “poor” to pay full price.

Last August, Princeton University did something few thought possible: it detonated that model entirely.

A Revolution in Financial Aid

Starting this fall, Princeton announced that most families earning up to $250,000 a year will pay zero tuition. Those making under $150,000 won’t pay a cent—not for tuition, not for housing, not for meals, not even for textbooks. Nearly 70% of incoming students will receive grant aid that never has to be repaid.

On the surface, it’s a stunning act of educational altruism. But behind the generosity lies a $34 billion endowment, a newly imposed 8% federal tax on university wealth, and months of political pressure from Washington. Whether driven by idealism, strategy, or both, Princeton’s move could redefine college affordability for an entire generation.

Either way, higher education may never look the same again.

How the New Aid System Works

Princeton’s new three-tier financial aid model outpaces virtually every other university in the nation.

-

Families earning up to $150,000: Pay absolutely nothing. Princeton covers every expense—tuition, room, board, books, and personal costs.

-

Families earning between $150,000 and $250,000: Pay no tuition but may contribute modestly toward housing or living expenses.

-

Families above $250,000 (up to $350,000 or more): May still qualify for grants, especially if they have multiple children in college or unusual financial obligations.

The average Princeton aid package for the 2025–26 academic year now exceeds $80,000 per student, all in grants. No loans. No repayment. Princeton, notably, eliminated loans from its financial aid packages back in 2001—long before it became fashionable to do so.

From Modest to Monumental: How the Policy Evolved

Princeton’s financial aid revolution didn’t happen overnight. In 2022, the threshold for full aid stood at $65,000, before rising to $100,000 later that year. Now, just three years later, the limit has skyrocketed to $250,000—nearly a fourfold increase.

Among its Ivy peers, Princeton now sets the gold standard. Harvard offers free tuition for families earning up to $200,000. Yale, Penn, and Dartmouth hover between $75,000 and $180,000. Cornell caps full aid at $75,000. That means a family earning $180,000 could face a stark choice: pay full price at Harvard—or pay nothing at Princeton.

What looks like generosity is also strategic competition. In the race for top students, financial aid has become the new admissions weapon.

The Money Behind the Move

Princeton’s $34.1 billion endowment—one of the largest in the world—has generated an average annual return of 9.2% over the past decade. Those funds bankroll research, operations, and faculty salaries—but they also draw political scrutiny.

Earlier this year, President Donald Trump’s “One Big Beautiful Bill” introduced a tiered tax on university endowments, with rates reaching as high as 8% on investment income. For Princeton, that could mean a $217 million annual tax bill, according to estimates from the American Enterprise Institute (AEI).

Universities can lower their tax burden by adjusting how much wealth they hold per student—through expanding enrollment or increasing aid. In other words, spending more on students can actually save them millions in taxes.

By expanding aid at a cost of roughly $44 million per year, Princeton may be saving far more—financially, politically, and reputationally. As AEI researchers noted, “The actual revenue from the endowment tax could change dramatically if universities alter their behavior.”

So while the move looks benevolent, it’s also brilliant math: spend $44 million, potentially save $217 million, and earn praise for equality in the process.

The Real Cost of “Free” College

To appreciate the impact, consider this: Princeton’s sticker price for 2025–26 sits around $91,000—including $65,210 for tuition, $12,500 for housing, and $9,000 for food. Twenty-five years ago, tuition was only $24,630. In a single generation, it’s risen by more than 160%.

Across the country, the same trend holds. Tuition and fees at private colleges have climbed over 5% just since 2024. Meanwhile, Americans now owe over $1.7 trillion in student loan debt, with many borrowers facing decades of repayment.

For Princeton students, that burden disappears—if they can get in. The university’s acceptance rate remains brutally low, hovering around 4%. For those admitted, however, the payoff is transformative: a world-class education without the lifelong debt sentence.

A Record-Breaking Class of 2029

This fall, Princeton will welcome about 1,409 new students, and a record 25% of them qualify as low-income, up from 21.7% last year. That marks the highest share of Pell Grant–eligible students in Princeton’s history. Nearly 70% will receive some form of financial aid.

The university’s demographics are also shifting. First-generation college students now make up 16.7% of the class, while legacy admits—traditionally children of alumni—have dropped to just 12.4%. Thirty-two transfer students will join the class, including 22 U.S. military veterans and 27 community college transfers, many from New Jersey, New York, and California.

International representation remains robust: students hail from 65 countries, accounting for 14% of the class. In total, Princeton’s incoming freshmen come from nearly every U.S. state and territory, making this one of its most geographically and socioeconomically diverse classes ever.

Shifting Demographics and Legal Shadows

The class also reflects the aftershocks of the Supreme Court’s 2023 ruling that restricted race-based admissions. Asian American enrollment jumped to 27.1%, while Black student representation dropped from 8.9% to 5%. Hispanic and Latino numbers held steady at 9.2%, while 8.2% of students declined to report race altogether—an all-time high.

The changes underscore how diversity metrics are evolving in the post–affirmative action era. Princeton insists its mission remains inclusive, but the numbers reveal a new reality in how students present their identities—and how universities measure equity without explicit racial considerations.

Can Other Universities Compete?

Every Ivy League school now offers full tuition to students from low-income families, but Princeton’s threshold of $250,000 leaves everyone else scrambling to keep up. Schools with smaller endowments—like Brown, Dartmouth, and Cornell—simply can’t match that scale of generosity without threatening their budgets.

Harvard and MIT are expanding aid for middle-income families, but both face cost-cutting pressures. Harvard recently froze hiring and trimmed administrative staff. Yale and Stanford face similar strains amid endowment taxes and political scrutiny.

That divide is widening: elite schools with massive endowments can now market “free” education, while less wealthy institutions—public and private alike—risk losing top students to better-funded competitors.

A Political and Financial Balancing Act

Princeton’s timing wasn’t random. The Trump administration recently suspended dozens of research grants, while threatening further funding cuts to universities deemed “noncompliant” with new regulations. The message from Washington is clear: elite institutions must adapt or pay the price.

By dramatically expanding aid, Princeton signals moral leadership while mitigating financial exposure. It’s both a strategic shield and a statement of values.

As Provost Jennifer Rexford put it, “Through our increased investment in financial aid, we’re making the transformative experience of a Princeton education more affordable for more students than ever.”

Whether that’s genuine altruism or strategic maneuvering, the effect is the same: thousands of students who never dreamed of affording Princeton now have a real shot.

The Next Chapter in Higher Education

As the Class of 2029 moves onto campus, the experiment begins. Will Princeton’s gamble pay off in the long term? Will rival universities follow suit or fall behind? Could this spark an “aid arms race” across elite academia?

For families once priced out of the Ivy League, this policy represents a doorway to possibility. For Princeton, it’s both a statement of purpose and a savvy response to political and economic forces beyond its gates.

If the past century of higher education was defined by rising costs and shrinking access, Princeton’s bold new model may mark the start of something entirely different—a future where the world’s most elite education is no longer reserved for the elite.

News in the same category

💪 Sarcopenia: Why Muscle Loss Happens & How to Fight It (After 50)

Japanese scientists delete chromosome that causes down syndrome

8 Signs That Two Souls Are Connected, No Matter The Distance

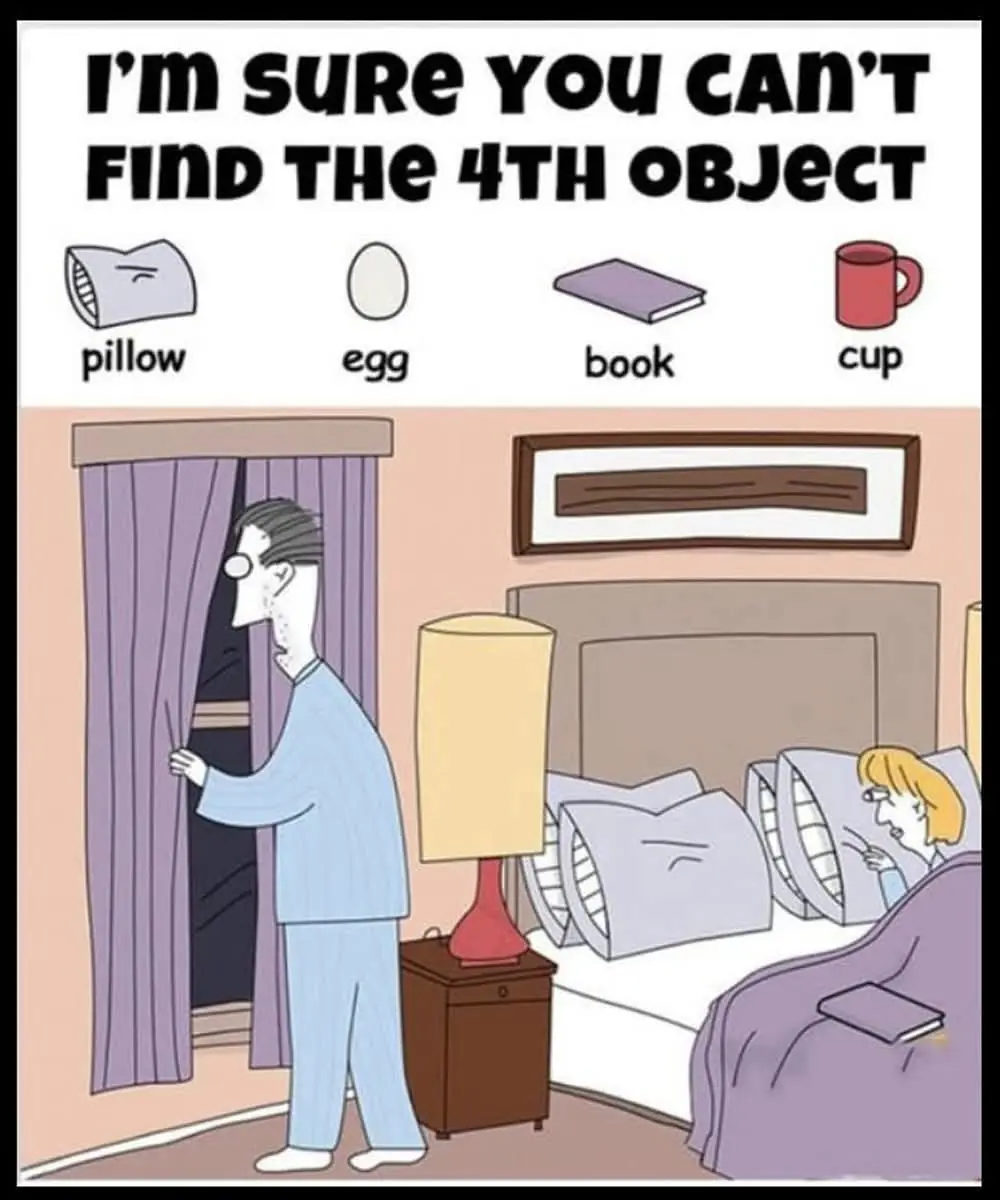

Can you spot the book, egg, cup, and pillow?

Inside Sweden’s Cashless Future: Thousands Opt for Microchip Implants

When a cat rubs against you, this is what it means

Zodiac Signs Most Likely to Have Prophetic Dreams

What Your Pile of Dirty Dishes Might Really Be Saying About You

Scientists Claim Black Hole Could Explode in the Next 10 Years—with 90% Certainty

9 Signs Your Partner Is Trying To Get Closer To You That You Might Not Realize

When a cat rubs against you, this is what it means

WHAT HAPPENS WHEN WE TONGUE KISS…See more

What makes a man leave his wife for another woman

How to Hold and Handle an Urn with Ashes: 3 Things You Should Always Remember

Can You Spot The Problem With This Picture

9,000 Mysterious Underwater Objects Detected Along US Coastlines Spark Navy Alarm

Ladies, when a man doesn’t appreciate you, DO THIS ...

Investigator Finds Dog Tied Up Under Scorching Sun, Marked with Leopard-Like Spots

News Post

5 Amazing Benefits Of Aloe Vera Gel For Skin: Large Pores, Dark Spots, Wrinkles

Clove & Lemon Collagen Drink: Wrinkle Free, Glowing Skin

Unlock Your Body’s Hidden Power: Try Garlic and Honey on an Empty Stomach for 7 Days

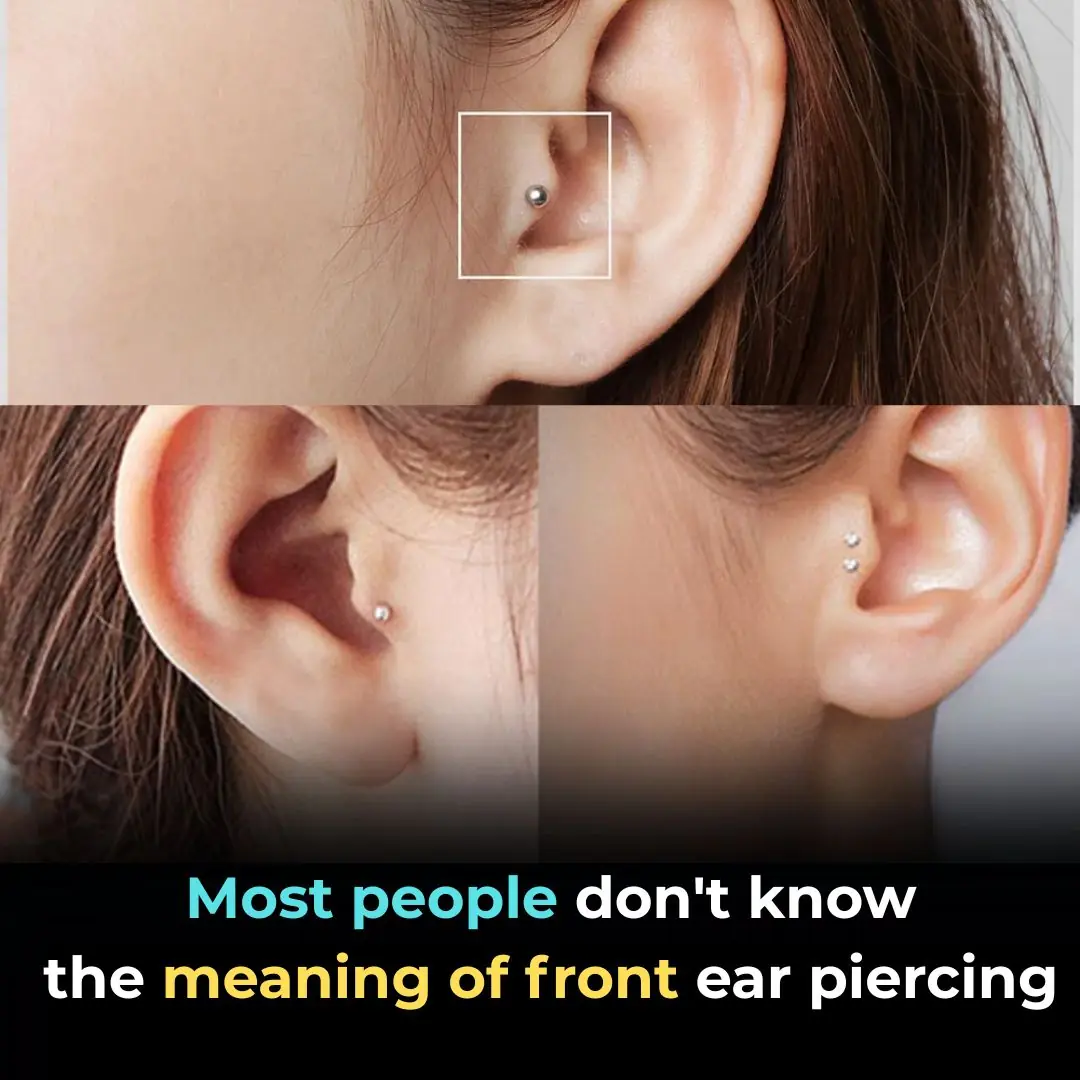

Tragus Piercing What Does It Mean

9 Health Benefits of Pine Needles

Unlock The Incredible Health Benefits of Garlic, Ginger and Lemon for Men

A special method to grow garlic in plastic bottles

7 Benefits of the Miracle Leaf of Life

7 Amazing Health Benefits of Banana Blossoms

Boiling Sweet Potatoes: Don’t Just Add Plain Water—Add This Spoonful for Perfectly Fluffy, Sweet Results

The Science Behind Putting a Cotton Swab in a Menthol Oil Bottle

More People Are Struggling with Visceral Fat — Doctors Reveal 9 Foods That Help Burn It Naturally

Black Turmeric vs. Yellow Turmeric: Which One Is Better?

Starve cancer: the diet rotation strategy you need to know

Like to see more from Tips for the Home

💪 Sarcopenia: Why Muscle Loss Happens & How to Fight It (After 50)

I Had No Idea About This!

These Ideas Are Amazing: 10 Clever Ways to Use Dryer Sheets Beyond the Laundry Room

Most Don’t Know: 13 Brilliant Ways to Use WD-40 Around the House