Tesla Faces Slump: Over 10,000 Cybertrucks Remain Unsold Amid Weak Demand

Tesla Faces Inventory Crisis: Over 10,000 Unsold Cybertrucks Piling Up

Tesla is reportedly sitting on more than 10,000 unsold Cybertrucks across lots in the United States, sparking serious concern among analysts about demand for its flagship electric pickup. This inventory glut — reportedly worth around $800 million — is a stark contrast to the company’s ambitious production goals.

In early 2025, Tesla sold only about 6,400 Cybertrucks, a number far below the company’s original targets. Even the introduction of a lower‑priced rear-wheel drive model failed to sufficiently boost demand.

Production Cutbacks and Shifting Priorities

Facing the growing inventory and weak sales, Tesla has begun scaling back Cybertruck production. Reports indicate that some staff at the Texas Gigafactory have been reassigned from the Cybertruck line to help build the more reliable and in-demand Model Y. The company’s decision to throttle production reflects not only the mounting inventory but also its shifting strategic focus.

Why Aren’t People Buying the Cybertruck?

Analysts point to several factors behind the weak demand:

-

Unconventional Design: The Cybertruck’s bold, angular stainless-steel body was expected to be a major draw. Instead, its polarizing design appears to have put off some traditional pickup buyers.

-

Quality Issues and Recalls: The truck has faced multiple recalls, including issues with panel alignment, falling body trim, and structural flaws.

-

Aggressive Discounts: In a bid to move inventory, Tesla has offered steep price cuts — up to $10,000 off certain models.

-

Resale Worries: Resale values for Cybertrucks have reportedly dropped significantly, which harms both new and used demand.

-

Brand and Leadership Concerns: Broader concerns about Tesla’s leadership and public image appear to be contributing to the slowdown.

Financial Impact and Risk

The mounting stockpile represents a serious financial burden for Tesla. Estimating an average sales price per Cybertruck, the floating inventory could be tying up nearly $800 million in capital. If production were halted, this could represent several months’ worth of unsold vehicles.

Production capacity is another concern. Tesla’s own reports suggest that Cybertruck manufacturing capacity could be as high as 125,000 units annually, but current output is far below that — suggesting underutilization and inefficiencies.

Market Implications and Future Outlook

Tesla’s mounting inventory could force a broader rethink of its pricing and marketing strategy for the Cybertruck. Analysts suggest that unless demand recovers — or Tesla offers even deeper incentives — the company may struggle to clear its backlog without taking a hit on margin.

On the other hand, shifting resources back to the Model Y, which remains a cornerstone of Tesla's business, could help stabilize revenue but may signal lower long-term confidence in the pickup. The Cybertruck’s future now hinges on whether Tesla can reignite consumer interest or manage the current surplus without excessive financial strain.

News in the same category

Why Some Children Don’t Visit Their Parents Often

Will Americans Receive $2,000 Stimulus Checks? What You Need to Know

14 Reasons to Drink Lemon Water First Thing in the Morning

Meet the Owners Behind Baltimore’s First Black & Woman-Owned Bodega

Quinta Brunson to Receive Keys to Hometown City of Philadelphia

Bethann Hardison & Andrew J. Young Honored at Gordon Parks Foundation Gala

Jay-Z & Luther Vandross’ First Albums Inducted Into GRAMMY Hall of Fame

Sheryl Lee Ralph Gets Emotional After Learning Her Ancestors Were Free People on ‘Finding Your Roots’

Philadelphia Entrepreneur Becomes The First Queer Black Woman To Lead A Biopharmaceutical Manufacturing Company

‘Tia Don’t Piss Me Off’: Tia Mowry’s Selfie with Mystery Man Has Folks Noticing He Looks Nothing Like Ex Cory Hardrict Despite Reunion Chatter

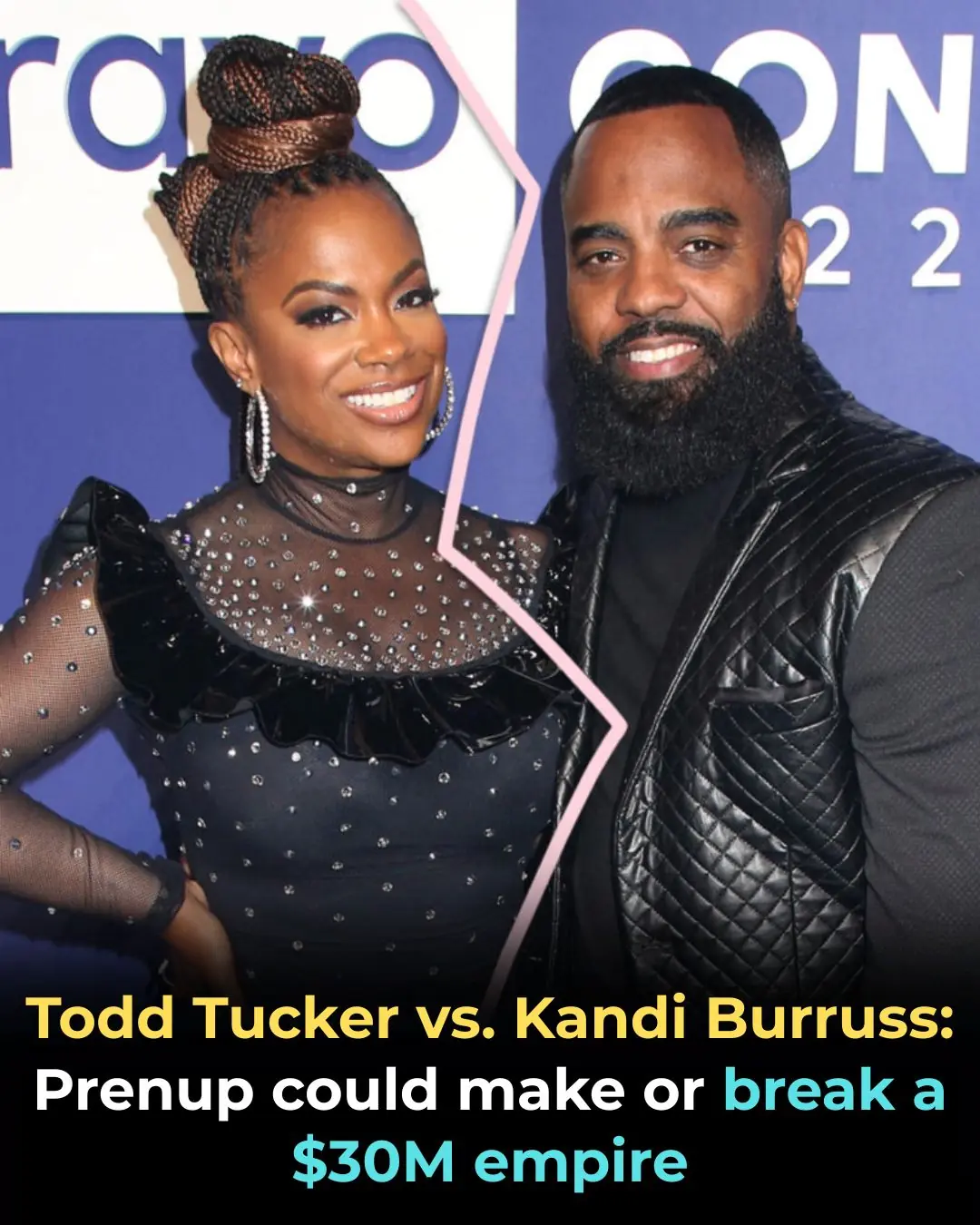

Todd Tucker vs. Kandi Burruss: Prenup Could Make or Break a $30M Empire

HBCU Grad Rajah Caruth Secures Second Career NASCAR Truck Series Win

NPR’s Tiny Desk Celebrates Black Music Month With Performances by Amerie, Beenie Man, CeCe Winans & More

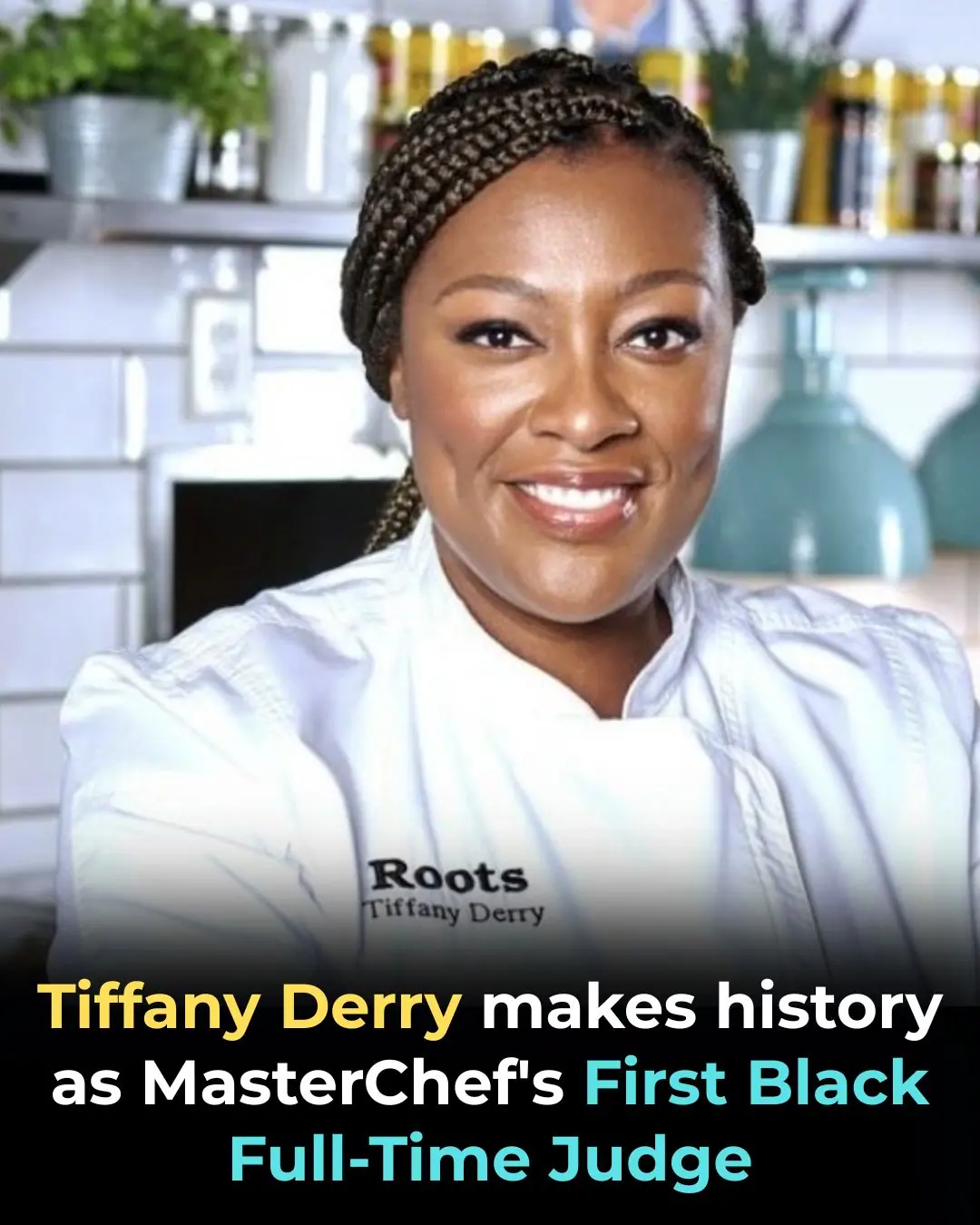

Tiffany Derry Makes History as MasterChef’s First Black Full-Time Judge

Kwame Onwuachi to Open New Restaurant ‘Maroon,’ the First Black Chef-Led Restaurant on the Las Vegas Strip

How Artists and Engineers Are Confusing Facial Recognition AI

Over a Million ‘Giant Eggs’ Discovered Near Deep-Sea Hydrothermal Vents

World’s First Full Human Eye Transplant Shows Promising Survival

News Post

Unlock Radiant Skin: The Ultimate Guide to Using Beetroot Gel for Glowing, Spotless Skin

Fenugreek Seeds for Hair Growth: The Power of Fenugreek Hair Rinse and Its Benefits for Hair

Japanese Milk Wax To Get Rid Of Unwanted Facial Hair

When Will I Outgrow My Acne? The Difference Between Adult and Teen Acne

5 Mascara Tips For Short Lashes

LEVEL UP YOUR LASH GAME: Top 5 Tips for Eyelash Extension Success!

Forehead Acne and What to Do About It

11 Common Eyebrow Mistakes Women Make in Their 60s (And How to Fix Them!)

How to Prevent and Treat Age Spots: Expert Tips for Radiant Skin

5 Ways Your Skin Changes as You Age and How to Keep It Vibrant

DIY Fenugreek Oil for Hair Growth – Get Thick Hair

Brow Boosting Serum: The Natural Way to Achieve Full, Thick Eyebrows

Why You Should Be Putting Salt in Your Toilet

Why Some Children Don’t Visit Their Parents Often

DIY Vaseline Cream: The 4-Ingredient Glow Hack That Makes Your Skin Baby-Soft Overnight

DIY Fenugreek Hair Masks for Hair Growth & Reducing Hair Fall

Will Americans Receive $2,000 Stimulus Checks? What You Need to Know

Revolutionary Miniature Implant Offers New Hope for Restoring Vision in Macular Degeneration Patients

A Simple Superfood That Enhances Your Baby's Brain Development During Pregnancy