Will Americans Receive $2,000 Stimulus Checks? What You Need to Know

Over the past weekend, Donald Trump posted on Truth Social that “most Americans” would receive a “dividend” of at least $2,000 per person. According to him, this payment would be funded by tariff revenue collected this year. He promised to distribute $2,000 stimulus checks to most U.S. citizens, although it is still unclear exactly who is included in the term “most Americans.”

Trump directly linked the feasibility of this proposal to tariff revenue generated through his trade policies. In his words: “People that are against tariffs are FOOLS! We are taking in Trillions of Dollars and will soon begin paying down our enormous debt — $37 trillion. Record investment in the USA, plants and factories going up all over the place. A dividend of at least $2,000 a person (not including high-income people!) will be paid to everyone.”

However, the administration has not announced any concrete plan on how this dividend would work in practice. There has been no clarification on income thresholds, a timeline for implementation, or specific qualification criteria. This initiative would also require approval from Congress and could face significant legal and political hurdles.

Despite this lack of clarity, the White House stated that Trump remains “committed” to the $2,000 payment proposal, according to Press Secretary Karoline Leavitt. However, she did not provide a timeline and declined to share further details about eligibility requirements, leaving many key questions unanswered.

Who Would Qualify?

According to current information:

-

Trump stated that a dividend of at least $2,000 would be paid to “everyone,” except for high-income individuals, but he did not define what “high income” means.

-

Treasury Secretary Scott Bessent suggested that families earning less than around $100,000 per year could qualify, but noted that this figure is still under discussion.

-

There has been no official confirmation on whether children would receive separate payments.

-

Past stimulus programs during the pandemic may offer some guidance. At that time, individuals earning under $75,000 and married couples under $150,000 received full payments, while higher earners received reduced amounts. However, this new proposal does not mention a tiered system and only refers to excluding “high-income” households.

Bessent also suggested that the benefits might come “in many forms,” not just direct cash payments. These could include tax cuts on tips, overtime pay, or Social Security benefits.

How Would This Plan Be Funded? Major Challenges Remain

Funding from Tariffs

Trump intends to use revenue generated by tariffs — taxes on imported goods — to fund the payments. His argument is that higher tariffs will encourage domestic manufacturing, reduce reliance on foreign goods, and generate enough revenue to both support the economy and distribute dividends to citizens.

According to the U.S. Treasury Department, the federal government had collected approximately $195 billion in tariff-related revenue by around September of this year.

Key Concerns

-

The cost of the program could be extremely high. Some estimates suggest that distributing $2,000 to most American adults could cost over $300 billion, far exceeding current tariff revenue.

-

Economists warn that tariffs raise the prices of imported goods, which leads to higher costs for consumers. Issuing stimulus payments on top of that could increase inflationary pressure.

-

Many lawmakers, including some within the Republican Party, are skeptical or opposed. They argue that tariff revenue should be used to reduce national debt, not to introduce new large-scale spending programs.

-

The plan does not yet have a clear legal framework and would require congressional approval, making its future uncertain.

Timeline

Trump has suggested that these payments could be distributed around mid-2026, although no specific date or schedule has been confirmed.

Key Takeaways

-

Proposal: A $2,000 payment for most Americans, excluding high-income earners, funded by tariff revenue.

-

Eligibility: Still unclear. Possible income limit around $100,000 per year, but not finalized. No clarity on children’s eligibility.

-

Funding reality: Current tariff revenue (~$195 billion) is likely insufficient to fund nationwide $2,000 payments.

-

Main obstacles: Risk of inflation, funding gap, legal and political challenges.

-

Potential timeline: Around mid-2026 — unconfirmed.

News in the same category

Meet the Owners Behind Baltimore’s First Black & Woman-Owned Bodega

Quinta Brunson to Receive Keys to Hometown City of Philadelphia

Bethann Hardison & Andrew J. Young Honored at Gordon Parks Foundation Gala

Jay-Z & Luther Vandross’ First Albums Inducted Into GRAMMY Hall of Fame

Sheryl Lee Ralph Gets Emotional After Learning Her Ancestors Were Free People on ‘Finding Your Roots’

Philadelphia Entrepreneur Becomes The First Queer Black Woman To Lead A Biopharmaceutical Manufacturing Company

‘Tia Don’t Piss Me Off’: Tia Mowry’s Selfie with Mystery Man Has Folks Noticing He Looks Nothing Like Ex Cory Hardrict Despite Reunion Chatter

Todd Tucker vs. Kandi Burruss: Prenup Could Make or Break a $30M Empire

HBCU Grad Rajah Caruth Secures Second Career NASCAR Truck Series Win

NPR’s Tiny Desk Celebrates Black Music Month With Performances by Amerie, Beenie Man, CeCe Winans & More

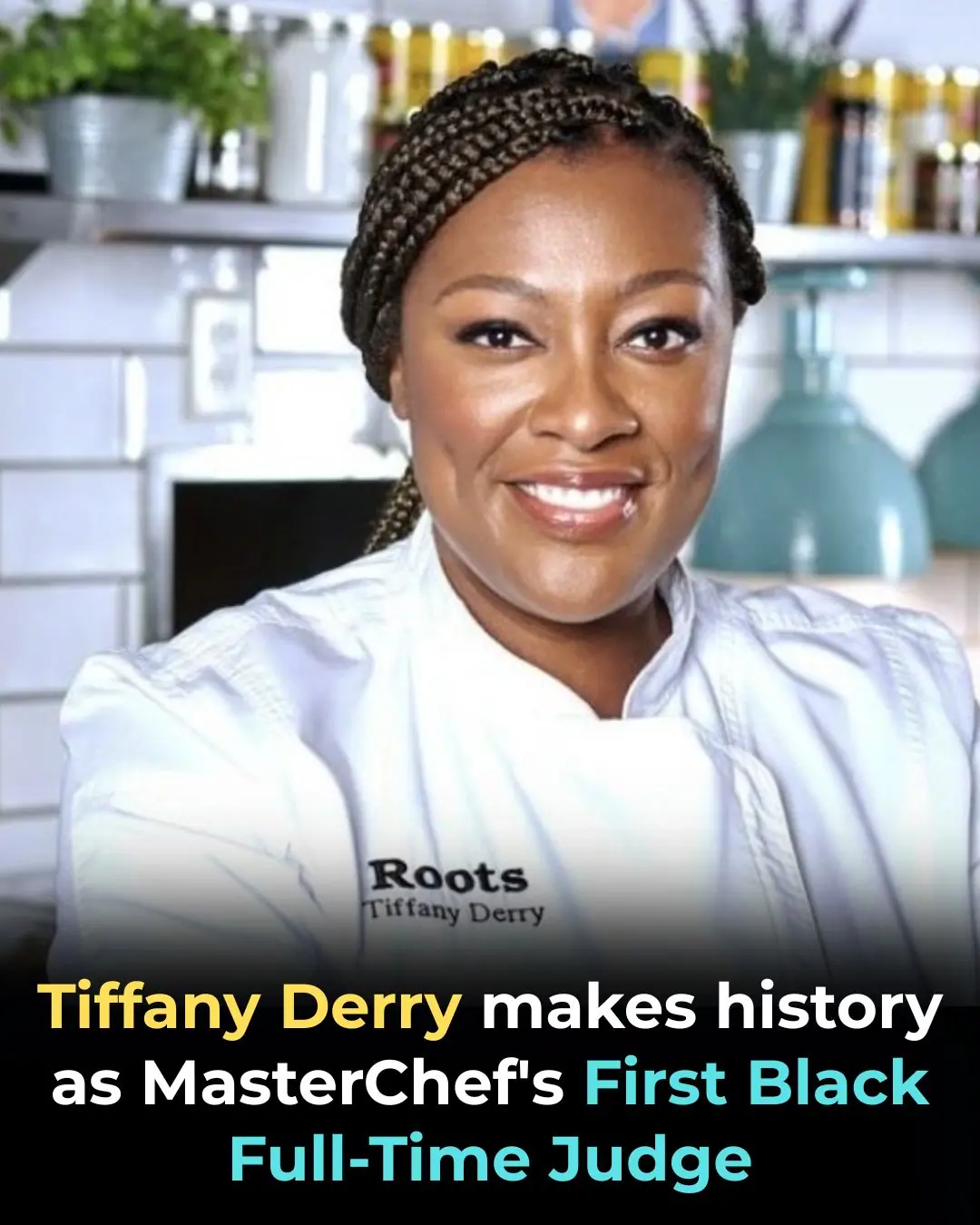

Tiffany Derry Makes History as MasterChef’s First Black Full-Time Judge

Kwame Onwuachi to Open New Restaurant ‘Maroon,’ the First Black Chef-Led Restaurant on the Las Vegas Strip

How Artists and Engineers Are Confusing Facial Recognition AI

Tesla Faces Slump: Over 10,000 Cybertrucks Remain Unsold Amid Weak Demand

Over a Million ‘Giant Eggs’ Discovered Near Deep-Sea Hydrothermal Vents

World’s First Full Human Eye Transplant Shows Promising Survival

How Childhood Trauma Shapes the Brain: Insights from Neuroscience

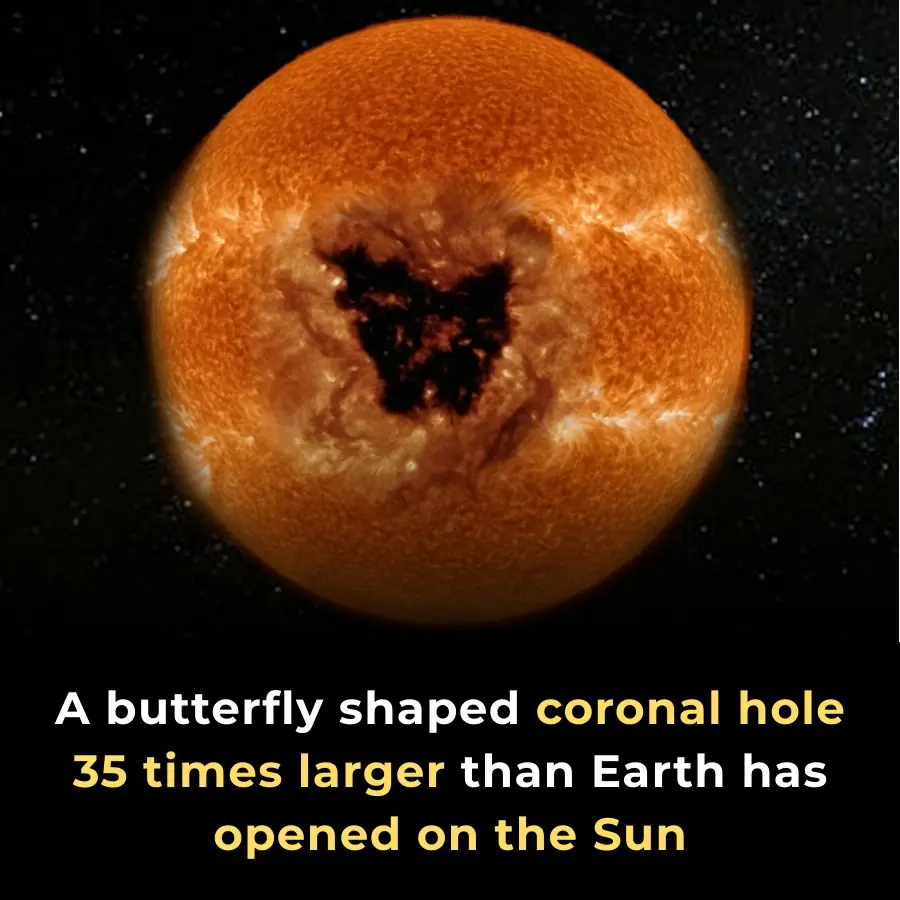

NASA Spots Giant Butterfly-Shaped Coronal Hole Sending Solar Wind Toward Earth

News Post

DIY Vaseline Cream: The 4-Ingredient Glow Hack That Makes Your Skin Baby-Soft Overnight

DIY Fenugreek Hair Masks for Hair Growth & Reducing Hair Fall

Revolutionary Miniature Implant Offers New Hope for Restoring Vision in Macular Degeneration Patients

A Simple Superfood That Enhances Your Baby's Brain Development During Pregnancy

Why Some Children Don’t Visit Their Parents Often

Don’t Drink Coconut Water Before You Know These 11 Secrets!

The #1 habit that’s destroying muscle in older adults—are you doing this?

Tomato Benefits for Skin – How Tomato Slices Can Transform Your Skin Naturally

This Plant Is Tastier Than Meat! 8 Reasons to Keep It in Your Garden

Walnuts Feed Your Microbiome: The Small Superfood That Transforms Your Gut and Your Mood

3 Steps Skin Care To Get Dewy Glass Skin

What happens when you start eating chia seeds every day

Why You Should Stop Using Petroleum Jelly On Your Skin (It’s a Byproduct of the Petroleum Manufacturing Process)

Air Conditioner Blowing Only Air but Not Cooling? Here’s How to Fix It Without Calling a Technician

14 Reasons to Drink Lemon Water First Thing in the Morning

Had no clue about this

Scientifically Proven Health Benefits of Cayenne Pepper

Why Does Your Refrigerator Frost Over and Does It Increase Electricity Consumption?