Florida Officially Recognizes Gold and Silver as Legal Currency Starting July 2026

Florida to Recognize Gold and Silver Coins as Legal Currency Beginning July 1, 2026

Florida has taken a historic step in reshaping its monetary landscape by officially recognizing certain gold and silver coins as legal currency in the state, effective July 1, 2026. Governor Ron DeSantis signed House Bill 999 into law after it passed both chambers of the Florida Legislature with overwhelming support, making Florida the largest U.S. state to adopt such a legal framework so far.

Under the new legislation, qualifying gold and silver coins that meet specified purity and marking standards — including clear indications of weight, purity, and mint of origin — will be legally recognized for the payment of debts, taxes, and everyday transactions when both parties agree to their use. According to the bill’s official analysis, the law also requires implementing rules from the Florida Chief Financial Officer and Financial Services Commission, which must be ratified by the Legislature before full implementation on the effective date.

One of the central features of the new policy is the exemption of eligible gold and silver coins from Florida state sales tax, designed to remove financial barriers and encourage broader circulation of these precious metals. Previously, a $500 minimum purchase threshold applied for certain bullion tax exemptions, but recent tax reforms in Florida have eliminated those limits altogether, ensuring that all qualifying coins can be purchased without sales tax regardless of transaction size.

While the law recognizes these metals as legal tender, it does not require businesses or individuals to accept gold or silver for transactions; participation remains voluntary. Instead, it provides a formal legal alternative to the U.S. dollar, giving Floridians more choice in how they conduct financial exchanges.

Proponents of the legislation argue that offering “sound money” options will benefit residents who are concerned about inflation, federal monetary policy, and the long-term stability of the dollar. Governor DeSantis and supporters framed the move as a means of expanding financial freedom and providing Floridians with tools to protect their wealth against currency devaluation.

Economists and legal analysts note that this initiative aligns with a broader movement in several U.S. states toward recognizing precious metals in commerce. Other states, including Missouri and Alabama, have passed comparable legal tender laws in recent years, reflecting growing interest in alternatives to traditional fiat systems.

Critics of such policies caution that while recognizing gold and silver as legal tender may be symbolic and offer more options for consumers and investors, it does not replace the central role of the U.S. dollar or federal monetary authority. They also point out that practical use of precious metals in everyday transactions may be limited by logistical challenges, such as valuation, portability, and electronic payment integration. Nevertheless, the law anticipates growing financial innovation, including potential systems for electronic transfers backed by precious metals.

As Florida moves toward implementation in mid-2026, financial institutions, coin dealers, and technology firms are exploring how to integrate gold and silver into practical payment systems. This includes the possibility of debit cards or digital platforms that link users’ accounts to physical gold or silver holdings, effectively allowing seamless payments in precious metals when desired.

In summary, Florida’s new legal tender law represents a significant shift toward monetary diversification, reflecting broader national discussions about sound money, inflation hedging, and economic sovereignty. Whether this policy will lead to widespread use of gold and silver coins in everyday transactions remains to be seen, but it clearly marks an important moment in state-level financial innovation.

News in the same category

The Woman Who Refused to Quit: How Jacklyn Bezos Changed Her Life—and Helped Shape the Future of the World

San Francisco Establishes Reparations Fund Framework to Address Historical Racial Inequities

From Prison Food to Fine Dining: How Lobster Became a Luxury in America

Michael B. Jordan Opens Up to David Letterman About His Future: ‘I Want Children’

Marlon Wayans Clarifies He Never Defended Diddy During His 50 Cent Rant

Snoop Dogg Becomes Team USA’s First Honorary Coach for 2026 Olympic Winter Games

Jason Collins announces he is battling stage 4 brain cancer: 'I'm going to fight it'

Kevin Hart Inks Licensing Deal for His Name

Michael B. Jordan Wanted to Change His Name Because of the Other Michael Jordan

Stranger Things fans have bizarre theory over final episode and everyone's saying the same thing

In Yakutsk, Winter Is So Cold People Never Turn Off Their Cars

JFK's grandson Jack Schlossberg shares emotional tribute to sister Tatiana after her death from cancer aged 35

Someone asked ChatGPT what it would do if it became human for a day and it gave a shocking response

Love and Generosity: How a Turkish Couple Shared Their Wedding with Refugees

Love and Perseverance Beneath the Waves: The 14-Year Search for Yuko

Rare Amoeba Infection Highlights the Importance of Safe Nasal Rinsing

A Legacy of Service: Bretagne’s Role in 9/11 and Disaster Response

Fears of a Texas Serial Killer Intensify After Three More Bodies Are Recovered from Houston Bayous

News Post

Tata Sierra vs Mahindra XUV 7XO: A Mid‑Size SUV Showdown 🚙🔥

This red, scaly patch won’t go away. It's all over my forehead and doctor isn't answering me. What is it?

I keep wondering why this happens to me

The Impressive Health Benefits of Guava Fruit and Leaves & How to Eat Guava (Evidence Based)

How to Naturally Increase Estrogen Levels

Evidence-Based Health Benefits of Honey (Raw, Pure, Natural) + Turmeric Golden Honey Recipe

Foamy Urine: Here’s Why You Have Bubbles in Your Urine

Why Almonds Are So Good for You: Health Benefits of Almonds Backed by Science

When Garlic Turns Harmful: Common Mistakes That Can Make a Healthy Food Risky

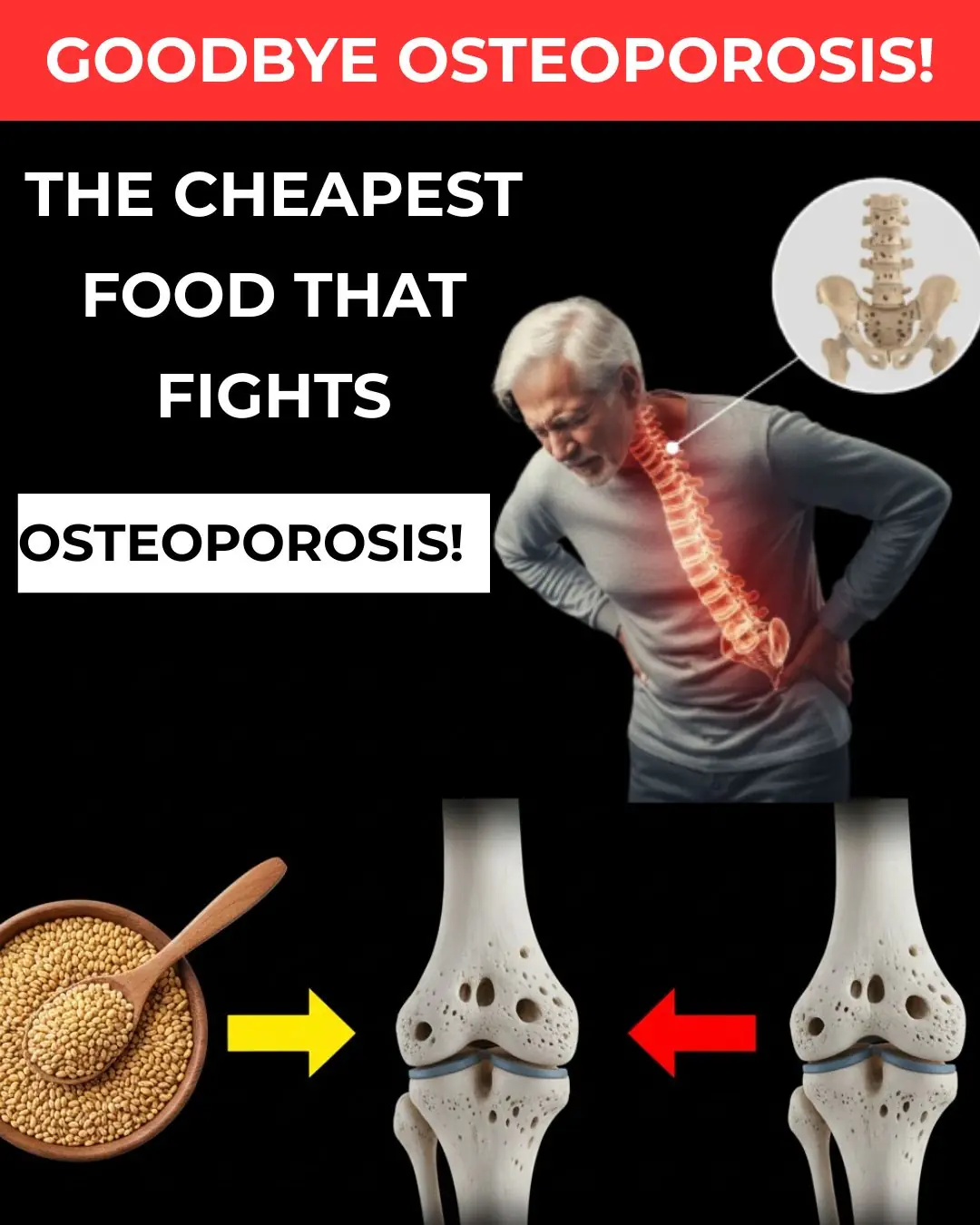

The Most Affordable Food That Supports Bone Health and Helps Fight Osteoporosis

Onion Water for Hair Growth: What It Can Do, What It Can’t, and What Science Really Says

A Cardiac Surgeon’s Warning: Why Many Elderly Patients Should Be Cautious About This Common Medication

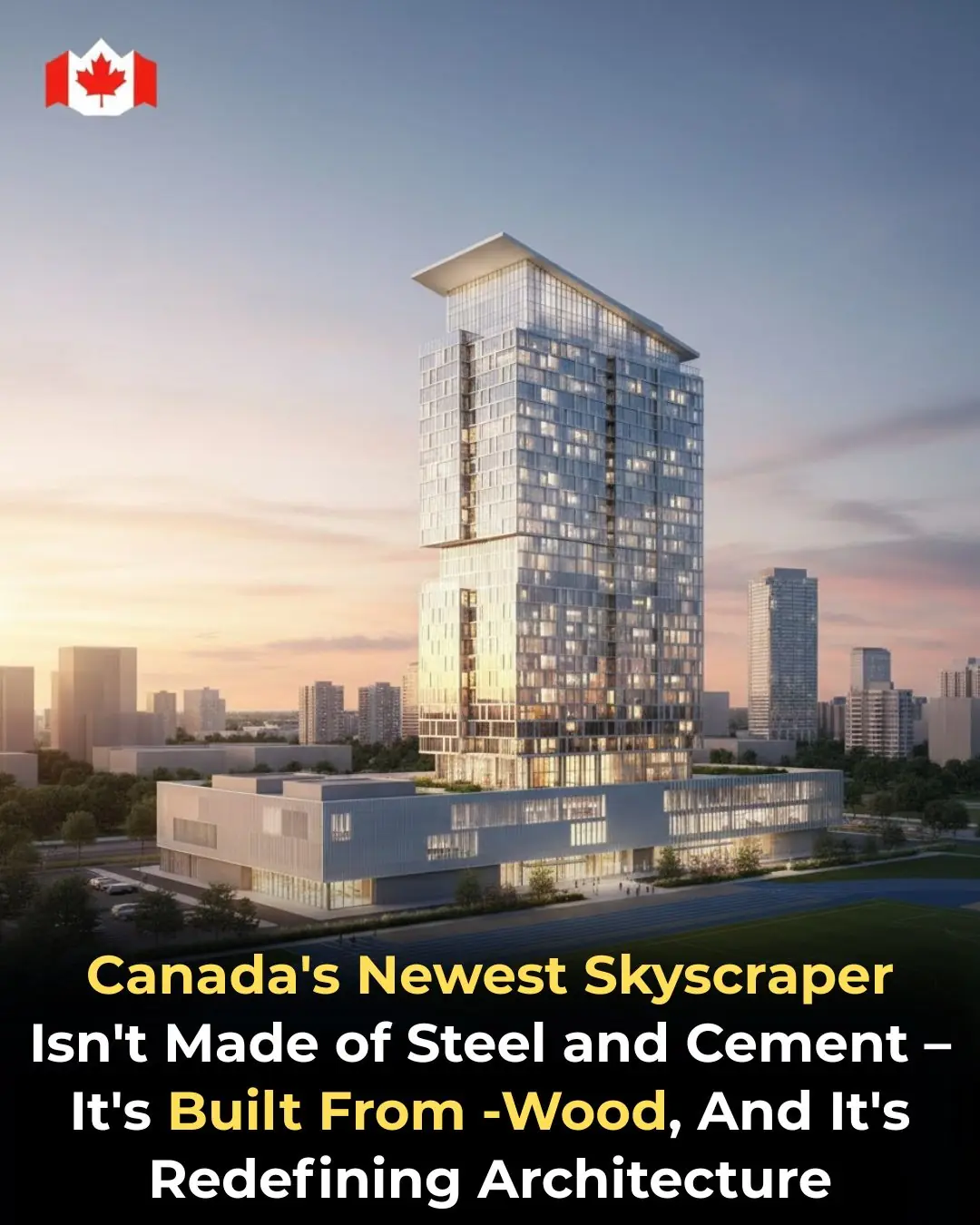

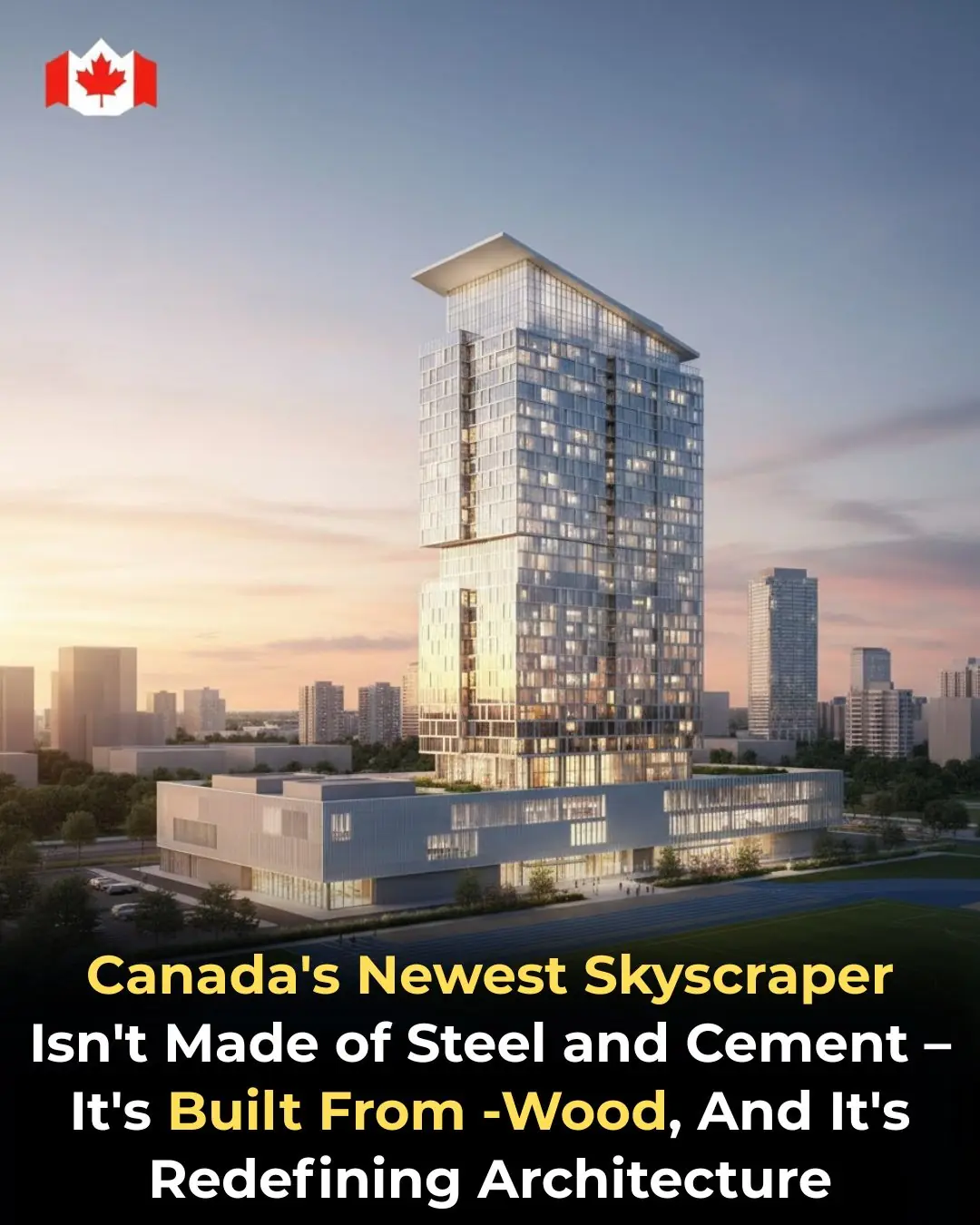

Canada Builds the Future in Wood: Inside Toronto’s Groundbreaking Timber Skyscraper

The Woman Who Refused to Quit: How Jacklyn Bezos Changed Her Life—and Helped Shape the Future of the World

San Francisco Establishes Reparations Fund Framework to Address Historical Racial Inequities

From Prison Food to Fine Dining: How Lobster Became a Luxury in America

No Reset: When a Clinical Mindset Takes Over Your Whole Life

India’s Olympic Ambition vs. Football’s Struggle ⚽🏟️🇮🇳

Brishti Gupta: Turning a Home Kitchen into Global Inspiration 👩🍳❤️🌍