Gen Z’s Sleepless Nights: Financial Anxiety and Its Impact 💰💤

A recent study reveals that 70% of Gen Z report struggling to sleep due to financial anxiety. As this generation navigates rising living costs, student debt, and uncertain job markets, the stress of managing money and securing a stable future is taking a toll not only on their wallets but also on their mental and physical health.

Financial Well-Being as Health

Traditionally, health has been defined in terms of physical fitness and mental clarity. But experts now emphasize that financial well-being is a critical pillar of overall health. According to the American Psychological Association (APA), financial stress is one of the leading causes of anxiety among young adults, often manifesting in sleep disturbances, depression, and difficulty concentrating. The World Health Organization (WHO) also highlights that economic insecurity is a major social determinant of health, influencing both mental resilience and physical outcomes.

The Toll of Financial Insecurity

Financial stress doesn’t just affect bank accounts—it impacts the body and mind. Chronic worry about bills, rent, or student loans can lead to:

-

Sleep disturbances, including insomnia and restless nights.

-

Heightened anxiety and depression, as uncertainty about the future weighs heavily.

-

Physical symptoms, such as headaches, fatigue, and weakened immune response.

Research from the Harvard School of Public Health shows that prolonged financial strain can increase cortisol levels, the body’s stress hormone, which in turn disrupts sleep cycles and overall wellness.

Coping Strategies for Financial Stress

Managing financial anxiety requires both practical and emotional approaches. Experts recommend:

-

Financial planning: Creating budgets, tracking expenses, and setting realistic savings goals.

-

Seeking support: Talking with financial advisors, mentors, or trusted friends to reduce isolation.

-

Healthy coping mechanisms: Practicing mindfulness, exercise, or journaling to manage stress.

-

Education and resources: Programs like the National Endowment for Financial Education (NEFE) provide tools to help young adults build financial literacy and confidence.

A Collective Challenge

Gen Z’s struggles reflect broader economic pressures, including inflation, housing costs, and student debt burdens. Addressing these challenges requires systemic solutions, but individuals can still take steps to protect their mental health. Building financial resilience is not just about money—it’s about creating stability that supports emotional and physical well-being.

A Call to Share and Support

This study is a powerful reminder that taking care of our finances is just as important as caring for our bodies and minds. By sharing experiences, tips, and coping strategies, communities can help reduce the stigma around financial stress and foster a culture of support.

References (plain text):

-

American Psychological Association – Financial stress and mental health (2023)

-

World Health Organization – Social determinants of health and economic insecurity (2024)

-

Harvard School of Public Health – Research on stress, cortisol, and sleep (2023)

-

National Endowment for Financial Education – Financial literacy resources for young adults (2024)

-

CNBC – Coverage of Gen Z financial anxiety and sleep studies (2025)

News in the same category

Figo’s Bravery: A Testament to the Selflessness of Dogs 🐕💛

Braving the Storm: A Mail Carrier’s Act of Compassion ❄️💙

Belgian Prodigy Earns PhD in Quantum Physics at Just 15 🌟⚛️

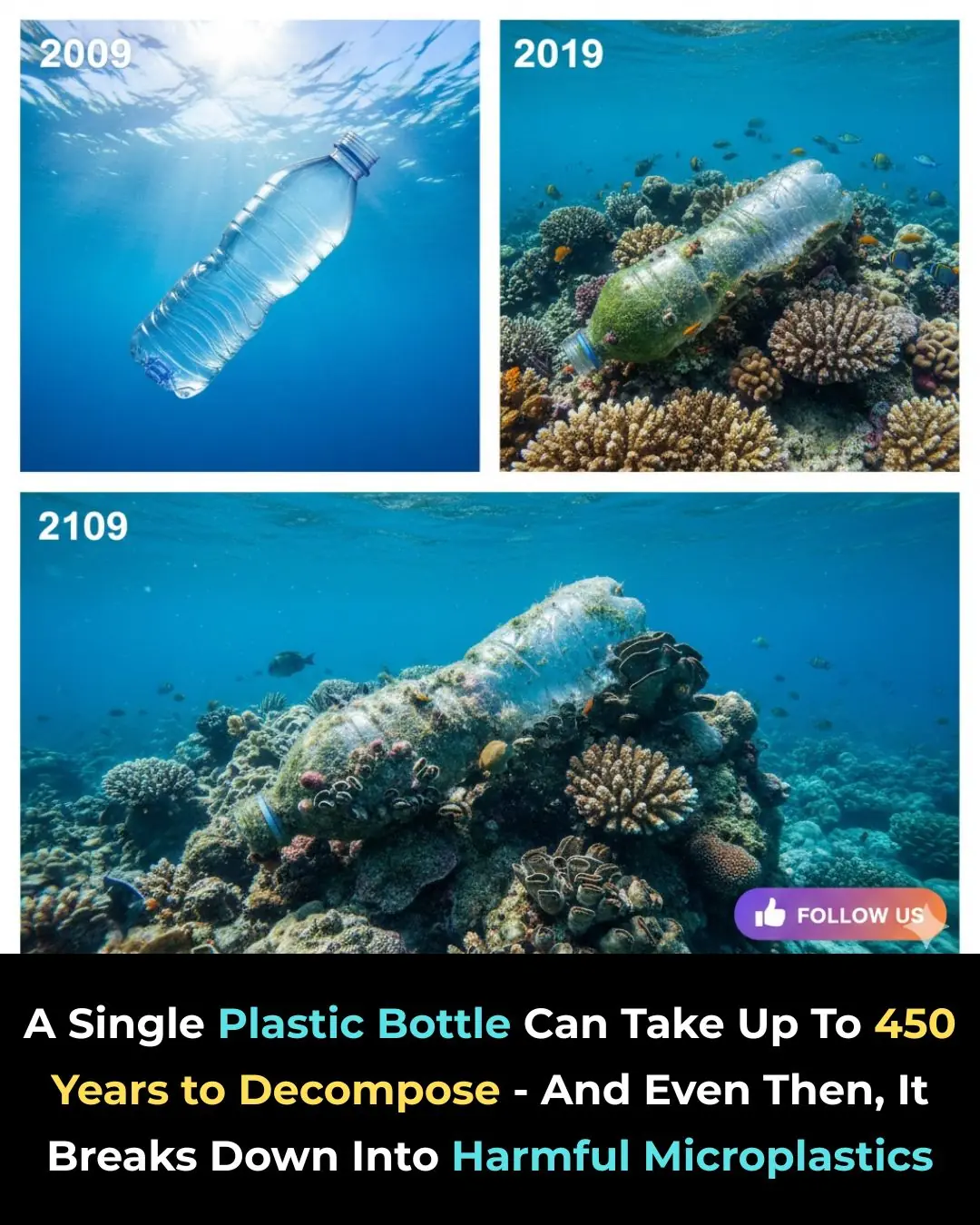

One Plastic Bottle. One Huge Problem. 🌍♻️

A Major Shake‑Up in the EV World: BYD Surpasses Tesla 🚗⚡🔋🌍

Curtis Allen Makes History: First HBCU Player to Win the Harlon Hill Trophy 🏈

Triple Success: Belcher Triplets Graduate Summa Cum Laude 🎓📚

Dutch Citizens Take Legal Action Against Global Figures Over mRNA Vaccines

The Healing Power of Small Gestures in Hospitals 💧💕

From Coal to Clean: Maryland’s Largest Solar Farm Goes Live 🌞⚡🌿

Jeff Bezos: “Earth Has No Plan B” — Why Industry May Need to Move Into Space 🌍🚀

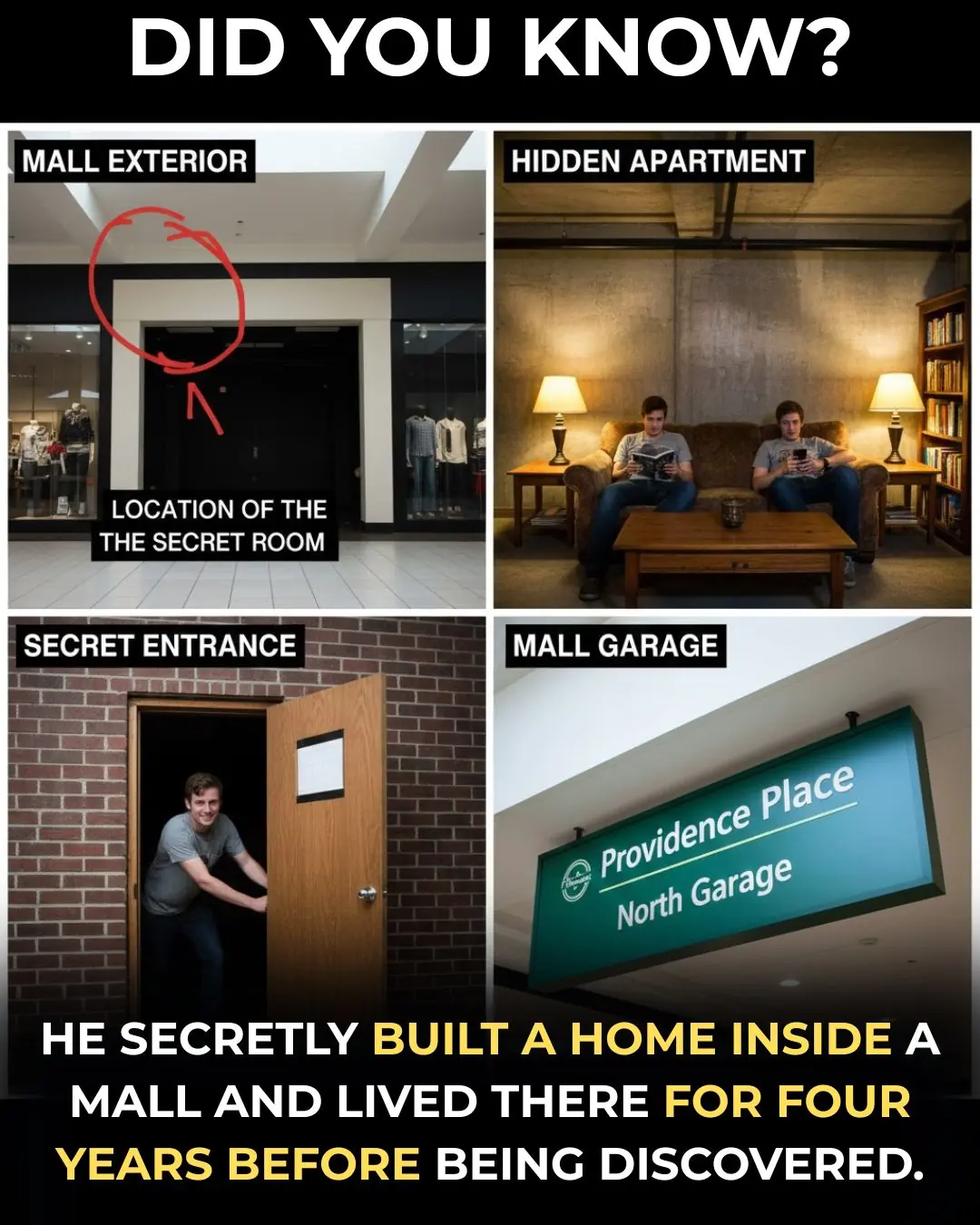

Hidden Apartment in a Mall: A Story of Resourcefulness 🏙️💡

Florida Makes It a Felony to Abandon Dogs During Hurricanes Under Trooper’s Law

Costco Builds Apartments Above Its Stores to Tackle the Affordable Housing Crisis

Canada Opens Its First Free Grocery Store—Where Dignity Comes First

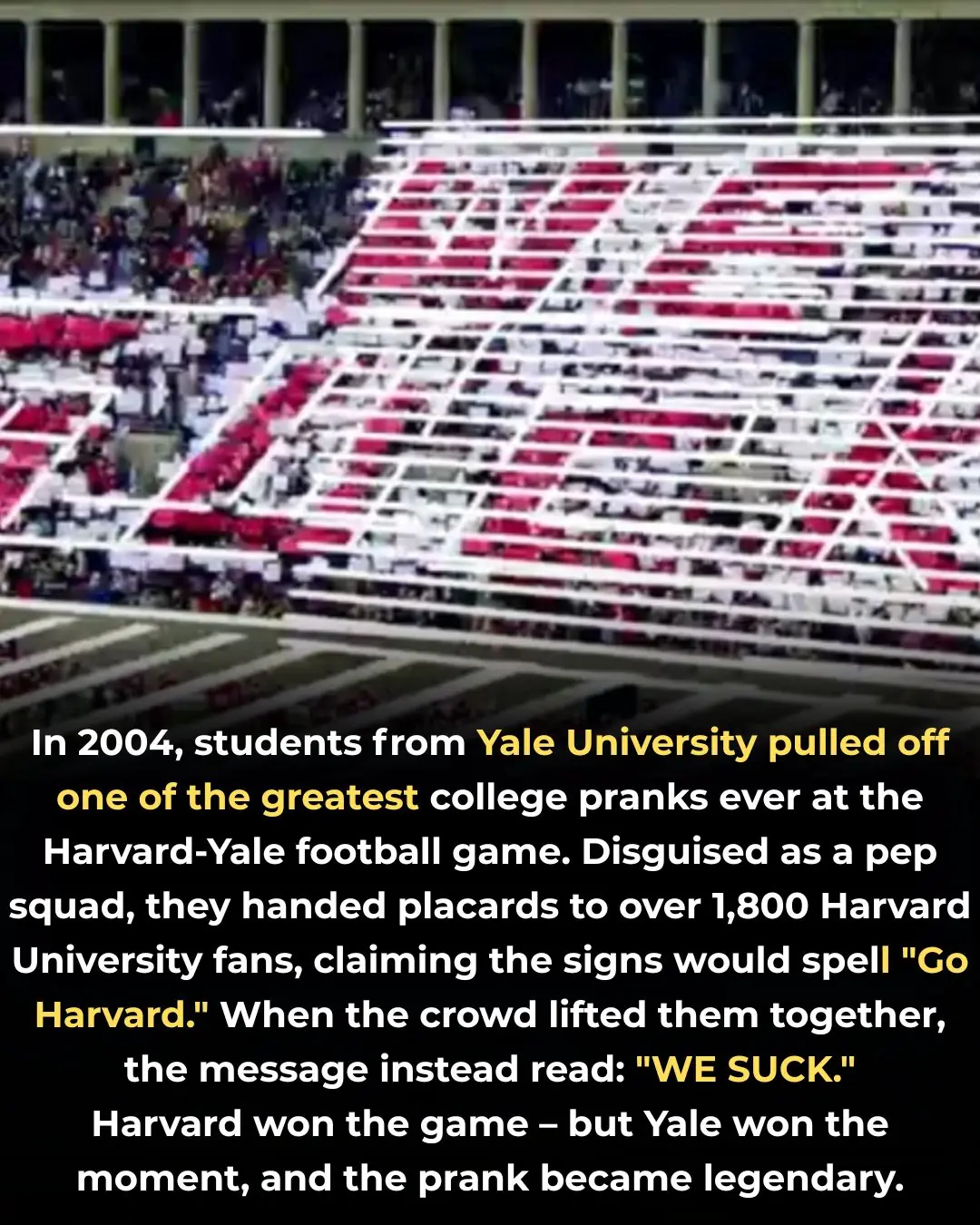

The Legendary “WE SUCK” Prank in the Harvard–Yale Rivalry

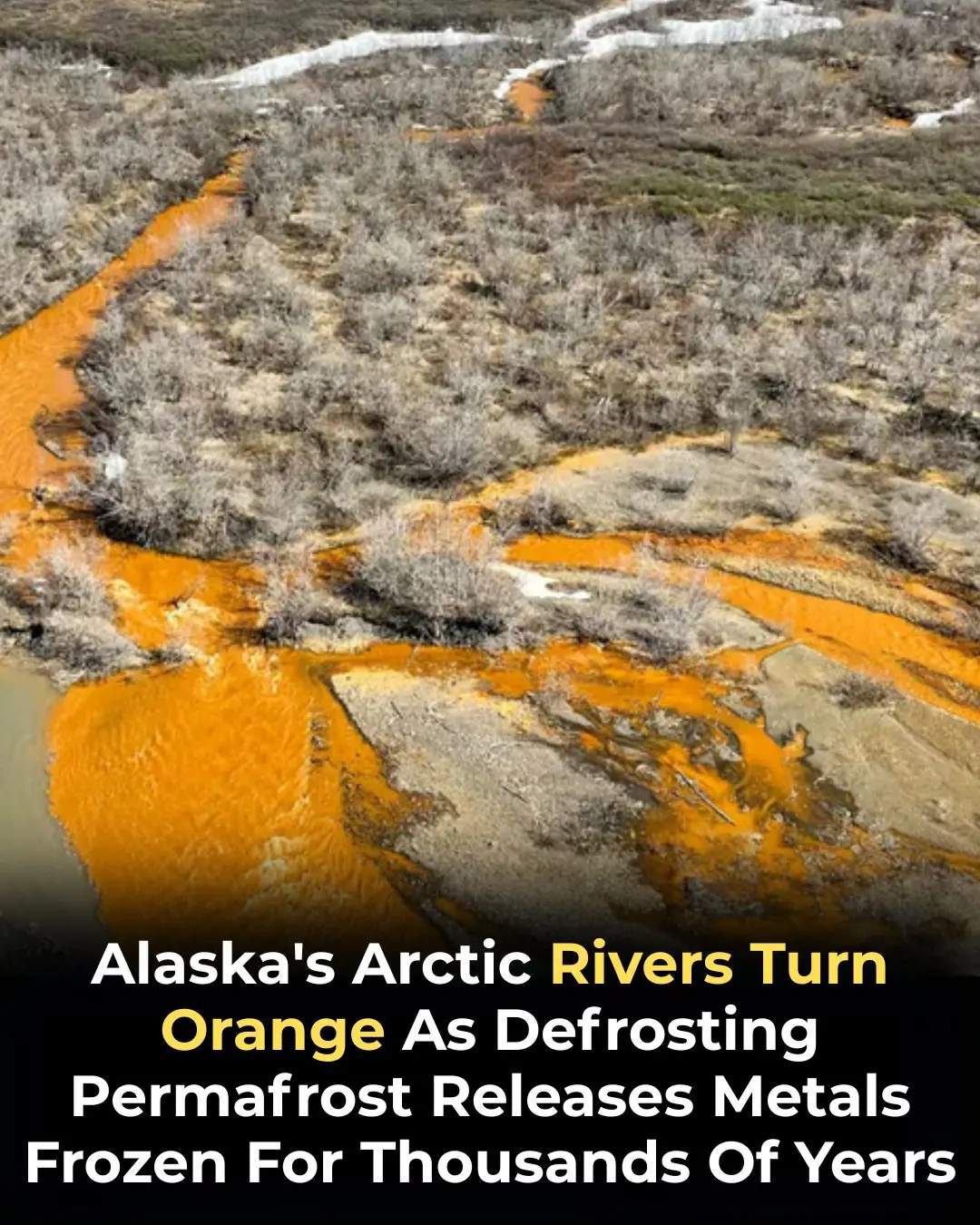

Alaska’s Rivers Turning Orange: A Warning Sign of Arctic Change

Lala Anthony Launches ThreeSixty Program to Support Young Men Leaving Rikers Island ❤️

News Post

Say Goodbye to Varicose Veins Naturally: A Simple Garlic, Onion, and Olive Oil Remedy That May Offer Relief

Why Seniors Are Turning to Honey and Cloves for Everyday Comfort After 60

Can Garlic and Lemon Really Support Better Vision? Kitchen Staples Your Eyes Might Appreciate

Banana Flower: The Underrated Superfood Taking Over in 2025

Fears of a Texas Serial Killer Intensify After Three More Bodies Are Recovered from Houston Bayous

From Casual Drinking to Dependence: A Recovering Alcoholic Reveals Seven Warning Signs of Addiction

Why Americans Were Shocked by the British Way of Washing Dishes

No one told me

My nose is getting bumpy, swollen, and red. Next doctor slot is way out. What should I do?

Can You Spot It? The Viral “Sniper Vision” Challenge That’s Testing Human Perception

Most Doctors Won’t Tell You, But This Can Cut Heart Attack & Stroke Risk By 80%

The Best Proven Ways to Heal Scars Naturally (Evidence Based)

How Japan Preserves Nature by Relocating Trees Instead of Cutting Them Down

16 Warning Signs of Poor Blood Circulation and How to Treat It

The Best Home Remedies For Getting Rid of Ear Infection

A Simple Act of Kindness That Turned a Lifelong Dream into Reality

Soap Left on Plates? British Dishwashing Method Sparks International Debate

A Hero on Four Paws: How a Cat’s Instincts Saved a Baby from an Alligator

Florida’s Trooper’s Law: A Landmark Step Toward Protecting Pets During Natural Disasters