Trump just revealed the exact date for $2,000 checks — is yours coming before christmas?

IRS Stimulus Check Update: Trump’s Proposed $2,000 Tariff Dividend Raises New Questions

As December 2025 begins, President Donald J. Trump’s suggestion of a $2,000 “tariff dividend” is generating renewed interest—and plenty of confusion. Americans want to know what the IRS is preparing, what Congress might approve, and who could be eligible if the idea ever becomes reality.

Right now, the numbers, the politics, and the economic implications are all under debate. Nothing is finalized, and officials emphasize that no payments are scheduled. Here’s the current landscape of the discussion.

What Trump’s Tariff Dividend Proposal Means

With the holiday season approaching, many Americans are asking whether a new IRS stimulus check is on the way. President Trump has floated the idea of issuing $2,000 checks to moderate-income households, funded by the massive revenue generated from tariffs.

The goal, according to Trump, is to route a portion of “hundreds of billions” collected from tariffs directly back to working- and middle-class Americans.

He has indicated that:

-

The payments would be aimed at moderate-income individuals.

-

Families could receive “thousands of dollars” per person, including additional amounts for children.

However, the proposal is still in the concept stage—not legislation. Trump even suggested that if the plan moves forward, the payments might begin in 2026, not December 2025.

While the idea is reminiscent of the pandemic-era stimulus checks, which put immediate cash into Americans’ hands to stimulate spending, the tariff dividend remains an unapproved policy, not an active program.

IRS and Treasury: No Stimulus Payments Scheduled

Both the U.S. Treasury and the IRS have confirmed that no stimulus checks or tariff dividends are scheduled for December 2025.

This means:

-

There will be no fourth stimulus check this month.

-

Any online rumors or social media claims suggesting otherwise are unverified.

Until Congress passes a formal bill, the IRS cannot prepare distribution systems or determine eligibility criteria.

The Math and Budget Challenges

Economic experts warn that the numbers behind the proposed plan may not add up. Even if tariff revenue reaches into the hundreds of billions, distributing $2,000 per adult and child could easily exceed the amount collected.

Other financial concerns include:

-

The 2025 federal deficit, projected to be around $1.8 trillion, leaves little room for new large-scale payments.

-

Trump’s suggestion to use future tariff revenue introduces additional budgetary and political risk.

Analysts note that fully funding such a program would require either significant new revenue streams or major federal budget adjustments—neither of which has been outlined.

Eligibility: Still Undefined

One of the biggest unknowns is who would qualify. If the income threshold is set near $100,000, tens of millions of Americans could be eligible. Additional payments for children would further increase the total cost.

So far, lawmakers and the Trump administration have not clarified:

-

The income limits

-

Whether children qualify and at what amount

-

How payments would be calculated

-

When distribution could begin

-

Whether it would be a one-time or recurring benefit

Without these specifics, the proposal remains largely hypothetical.

How Payments Might Be Delivered

If the plan eventually passes, the distribution system would likely mirror previous stimulus rounds:

-

Direct deposit for most taxpayers

-

Paper checks or debit cards for those without electronic information on file

Middle-income families would likely be the primary recipients, and those with children might receive enhanced benefits—although nothing is officially determined.

Bottom Line

For now, the $2,000 tariff dividend is not active, not approved, and not scheduled. Despite growing public interest, all claims of December 2025 payments are unsupported.

Until official legislation is introduced and passed by Congress, the idea remains a proposal—not a promise.

News in the same category

Golden Snub-Nosed Monkeys: A Glimpse of Wild Beauty in the Misty Mountains of China

Understanding the Extended Recovery Journey After Pregnancy

4 Things You Should Never Throw Away After a Funeral — And Why They Matter More Than You Realize

After Almost a Decade, Tennessee Zoo Celebrates Arrival of Newborn Gorilla

The Tiny Bacterium That Turns Toxic Metal Into Pure 24-Karat Gold

"EV Battery Longevity: How Modern Electric Vehicle Batteries Are Built to Last Up to 20 Years

Breakthrough Study Reveals COVID Vaccines Reduce Heart Attacks and Strokes

California Becomes the Fourth-Largest Economy in the World, Surpassing Japan in Nominal GDP

H5N1 Outbreak Causes Devastating Mortality in World's Largest Elephant Seal Colony

The Loneliest House in the World: The Fascinating Story of Elliðaey Island's Remote Lodge

Breakthrough in HIV Cure: Stem Cell Transplant Leads to HIV Remission Without CCR5-Δ32 Mutation

Study Reveals When You Focus on the Good, Your Brain Literally Rewires Itself to Look for More Good – That’s the Magic of Neuroplasticity

How Dan Price’s Bold Pay Cut Transformed Gravity Payments and Sparked a Wage Revolution

Portugal Enforces Groundbreaking ‘Right to Disconnect’ Law Protecting Workers’ Off-Hours

15-Year-Old Belgian Prodigy Laurent Simons Earns PhD in Quantum Physics, Redefining Academic Limits

Revolutionary Contact Lenses Enable Humans to See in the Dark Using Infrared Technology

Woman Breaks Into Shelter to Save Her Pit Bull From Euthanasia, Sparking National Debate

A Little Dog, a Big Moment: The Puppy That Captured Hearts at the Pope’s Parade

News Post

This Old-School Home Remedy Could Ease Back, Joint & Knee Pain in Just 7 Day

The Daily Drink That Helps Clear Blocked Arteries Naturally

12 Benefits of Bull Thistle Root and How to Use It Naturally

8 Warning Signs of Colon Cancer You Should Never Ignore

Explore Canada from Coast to Coast by Train for Just $558 🇨🇦: A 3,946-Mile Adventure Through Stunning Landscapes

Golden Snub-Nosed Monkeys: A Glimpse of Wild Beauty in the Misty Mountains of China

Understanding the Extended Recovery Journey After Pregnancy

Study: nearly all heart attacks and strokes linked to 4 preventable factors

4 Things You Should Never Throw Away After a Funeral — And Why They Matter More Than You Realize

Stop adding butter — eat these 3 foods instead for faster weight loss

Chicken Eggs with Mugwort: Highly Beneficial but Certain People Should Avoid Them

Watercress: The World’s Top Anti-Cancer Vegetable You Can Find in Vietnamese Markets

4 Plants That Snakes Absolutely Love — Remove Them Immediately to Keep Your Home Safe

The 4 “Golden Hours” to Drink Coffee for Maximum Health Benefits — Cleaner Liver, Better Digestion, Sharper Mind

Don’t Rip This Out — Treat It Like Gold Instead. Here’s Why.

Say Goodbye to Bare Branches: Revive Your Christmas Cactus Blooms with These Expert-Backed Hacks

Were You Aware of This? A Surprisingly Simple Spoon Trick Can Stop Mosquito Bite Itching

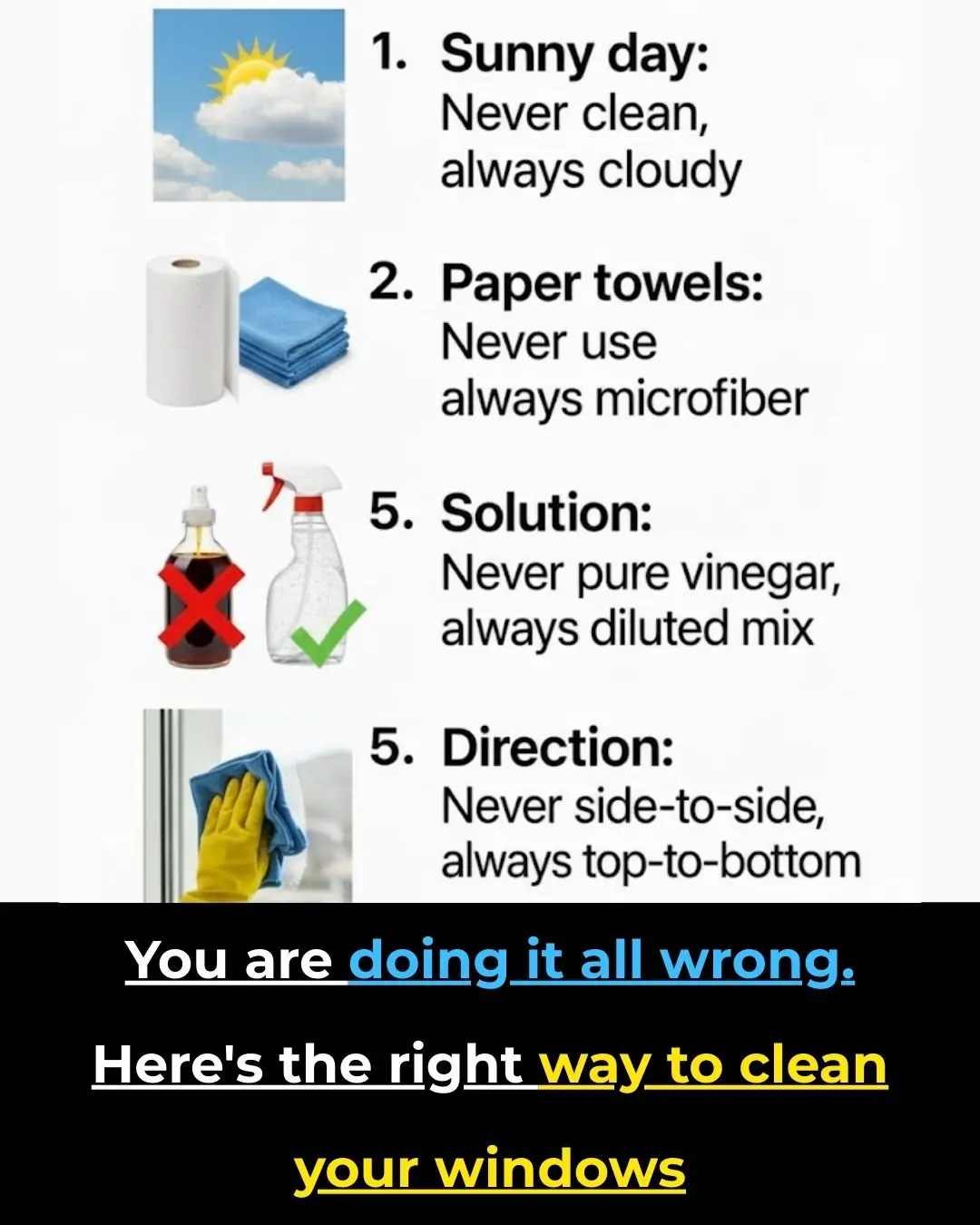

You’re Doing It All Wrong — Here’s the Right Way to Clean Your Windows

After Almost a Decade, Tennessee Zoo Celebrates Arrival of Newborn Gorilla