Stop wasting money on these 10 things

In today's fast-paced world, it's all too easy to spend money on things that aren’t truly necessary. Whether it’s the allure of convenience, social pressure, or simply not knowing better alternatives, many of us fall into spending habits that can quietly drain our wallets over time. By recognizing these habits, we can make conscious choices that lead to meaningful savings and smarter financial decisions.

Below, we highlight eleven common areas where people often waste money and provide practical tips on how to cut back. From everyday items like bottled water and coffee to larger recurring expenses like cable packages and impulse purchases, there are countless opportunities to redirect funds toward more meaningful pursuits, savings, or investments.

1. Stop Buying Bottled Water

Bottled water is expensive and environmentally harmful. On average, a single bottle costs between $1 and $3, and buying one daily can easily add up to over $1,000 per year. Instead, invest in a high-quality reusable water bottle and a home water filter, which may cost as little as $20. This switch not only saves money but also reduces plastic waste and environmental impact.

Additionally, tap water in most regions is tested for safety and quality, often matching or exceeding bottled water standards. You can also explore adding reusable water filters with activated carbon to improve taste, making hydration both cheaper and more sustainable.

2. Reuse Your Coffee Grounds

Coffee grounds have multiple uses beyond brewing your daily cup. Instead of tossing them, consider using them as a natural fertilizer for your plants. Rich in nitrogen, coffee grounds can enhance soil health and promote plant growth. Simply sprinkle them in your garden, mix with soil, or even add to compost.

They also serve as a natural deodorizer. Placing a bowl of dried coffee grounds in your fridge or shoes can help neutralize odors. By repurposing coffee grounds, you reduce waste and avoid buying chemical-based products, saving money while being eco-friendly.

3. Avoid Using Disposable Wipes

Disposable wipes—whether for cleaning, personal hygiene, or makeup removal—are convenient but costly and wasteful. A pack can cost around $5 and may last only a week. Opt for reusable cloths or microfiber towels that can be washed and reused many times.

For personal care, you can make DIY wipes using cloth squares soaked in water, coconut oil, and gentle soap. Homemade wipes are customizable, gentler on skin, and far more economical in the long run.

4. Freeze Herbs to Prevent Waste

Fresh herbs enhance dishes but often come in large bundles that go bad quickly. Instead, freeze them to extend their shelf life. Chop herbs and place them in ice cube trays, covering with olive oil or water. Once frozen, transfer to a freezer bag for easy use.

This simple method preserves flavor, reduces waste, and makes cooking more convenient. You can also experiment with freezing other ingredients like ginger, garlic, or lemon juice for easy meal prep.

5. Cut Back on Eating Out

Eating out is convenient but expensive. The average restaurant meal costs around $13, while a home-cooked meal costs approximately $4 per serving. Cooking at home more frequently can save hundreds or even thousands per year.

Meal planning, batch cooking, and prepping ingredients in advance make it easier to maintain a home-cooked diet. Trying new recipes can turn cooking into a creative and enjoyable activity rather than a chore. Even occasional home-cooked “restaurant-style” meals can satisfy cravings while keeping spending in check.

6. Limit Impulse Purchases

Impulse buying is a major contributor to unnecessary spending. On average, people spend around $5,400 annually on unplanned purchases. Combat this habit by implementing a 24-hour rule: wait a day before buying any non-essential item.

During the waiting period, evaluate whether the item is a true need or just a temporary desire. Creating a wishlist and prioritizing purchases can help ensure money is spent on what truly matters, avoiding buyer’s remorse and unnecessary clutter.

7. Cancel Unused Subscriptions

With the rise of subscription services, it's easy to lose track of monthly expenses. Streaming platforms, digital magazines, software subscriptions, and even subscription boxes can quietly add up. Review all recurring payments and cancel those you no longer use.

Subscription management apps can help track these expenses and prevent forgotten charges. Freeing up this money can be redirected toward savings, investments, or other priorities. Regularly auditing your subscriptions is a simple habit that yields long-term financial benefits.

8. Skip Name-Brand Products

Name-brand items often come with a premium price but little added value compared to generic alternatives. Household essentials like cleaning supplies, pantry staples, and personal care items can often be purchased in store-brand versions at a fraction of the cost.

Compare ingredients or specifications before buying. Often, differences are negligible, and switching to generic brands can save hundreds per year, especially on frequently purchased items. Combining this habit with bulk buying can maximize savings further.

9. Avoid Extended Warranties

Extended warranties are marketed as safety nets but often offer limited value. Many credit cards provide purchase protection, and most products already include a manufacturer’s warranty.

Before buying an extended warranty, consider the likelihood of needing it and the cost of repairs versus the warranty price. Often, setting aside the warranty cost in a dedicated savings fund gives you more flexibility and control over your money.

10. Reduce Energy Consumption

Reducing energy usage not only benefits the environment but also cuts utility bills. Simple actions, like switching to LED bulbs, unplugging electronics when not in use, and installing a programmable thermostat, can result in substantial savings.

Conducting an energy audit—many utility companies offer free audits—can help identify areas for improvement. Small changes like sealing windows or using energy-efficient appliances can lower consumption while having a lasting positive impact on the planet.

11. Reevaluate Your Cable Package

With countless streaming options now available, traditional cable subscriptions are often unnecessary. The average cable bill is around $217 per month, whereas streaming services usually cost much less.

Review your viewing habits and consider a mix of streaming services tailored to your preferences. Free trials are a great way to explore options before committing. Downsizing or eliminating cable can save hundreds annually, freeing funds for savings, experiences, or investments.

By implementing these strategies, you can significantly reduce wasteful spending, increase your savings, and adopt more sustainable habits. Small, consistent changes often lead to substantial financial improvements over time while also encouraging mindful, intentional living.

News in the same category

Simple way to repel cockroaches

Washing Machine Full of Dirt and Bacteria? Pour One Bowl of This Inside — It’ll Be Spotless and Fresh Like New!

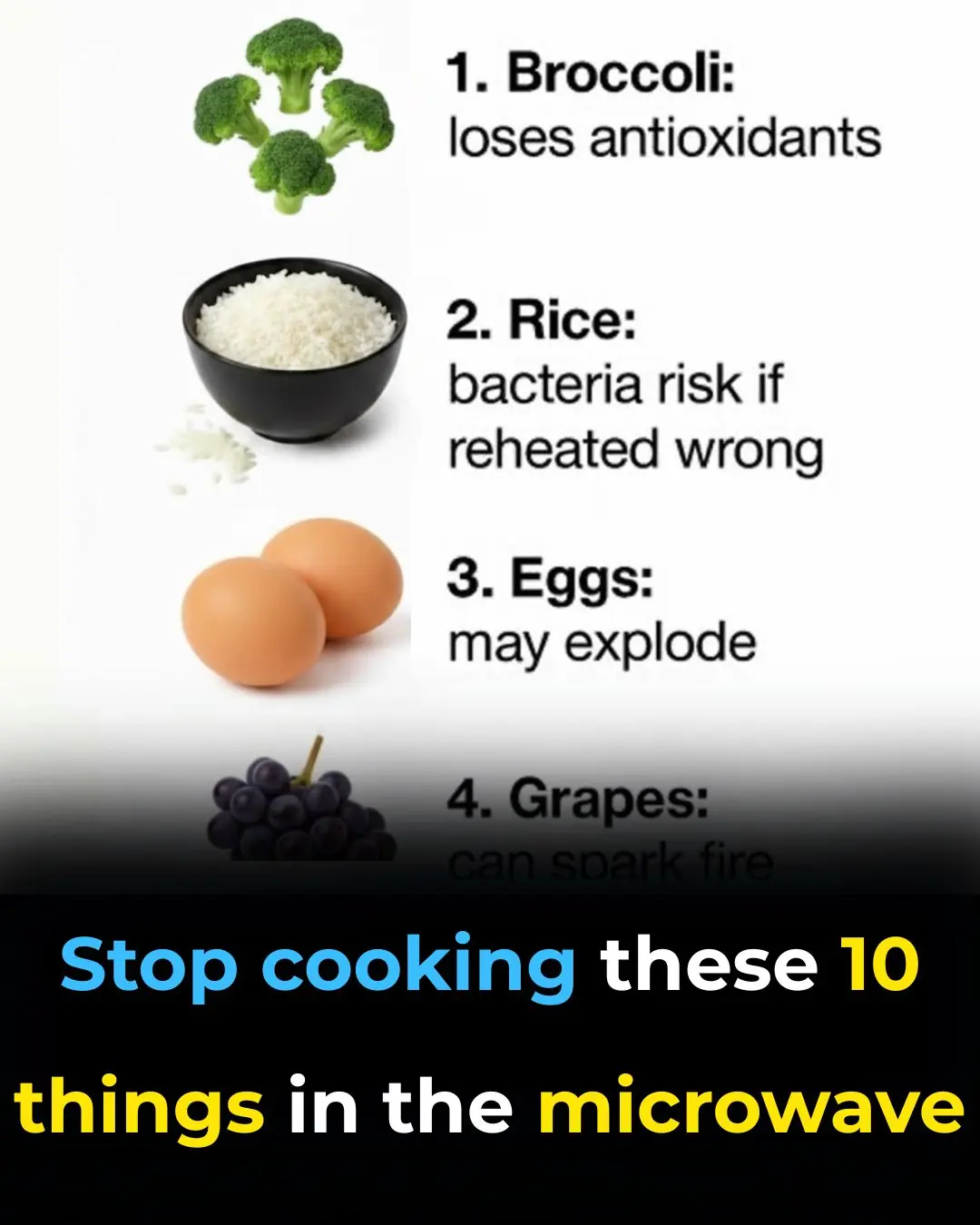

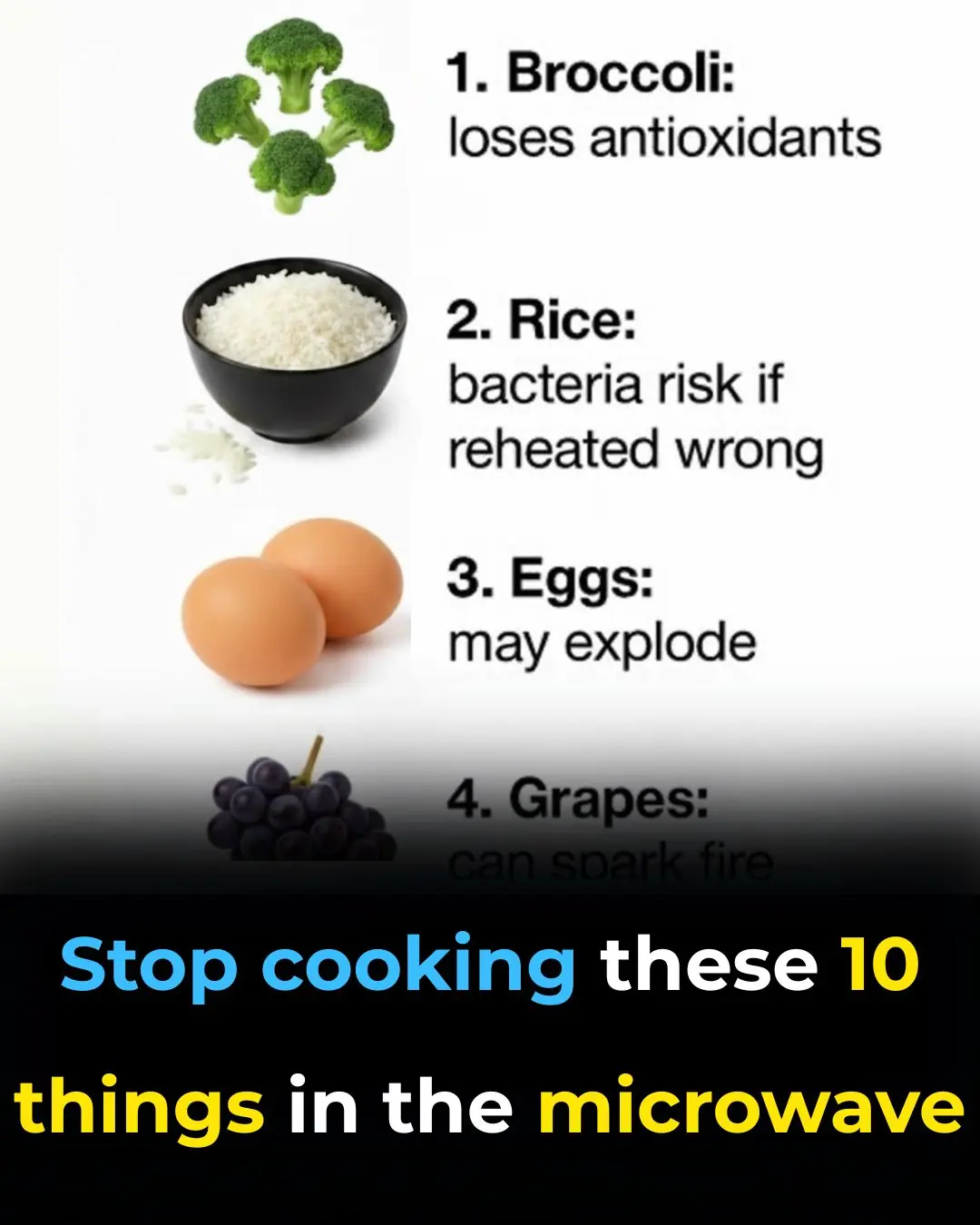

Stop cooking these 10 things in the microwave

Stop organizing these 10 things backwards

The Silica Gel Pack You Always Throw Away Has 6 “Magical” Uses: Great for Your Health and Elevates Everyday Life

Put ice cubes in to cook rice: The seeds are delicious and chewy

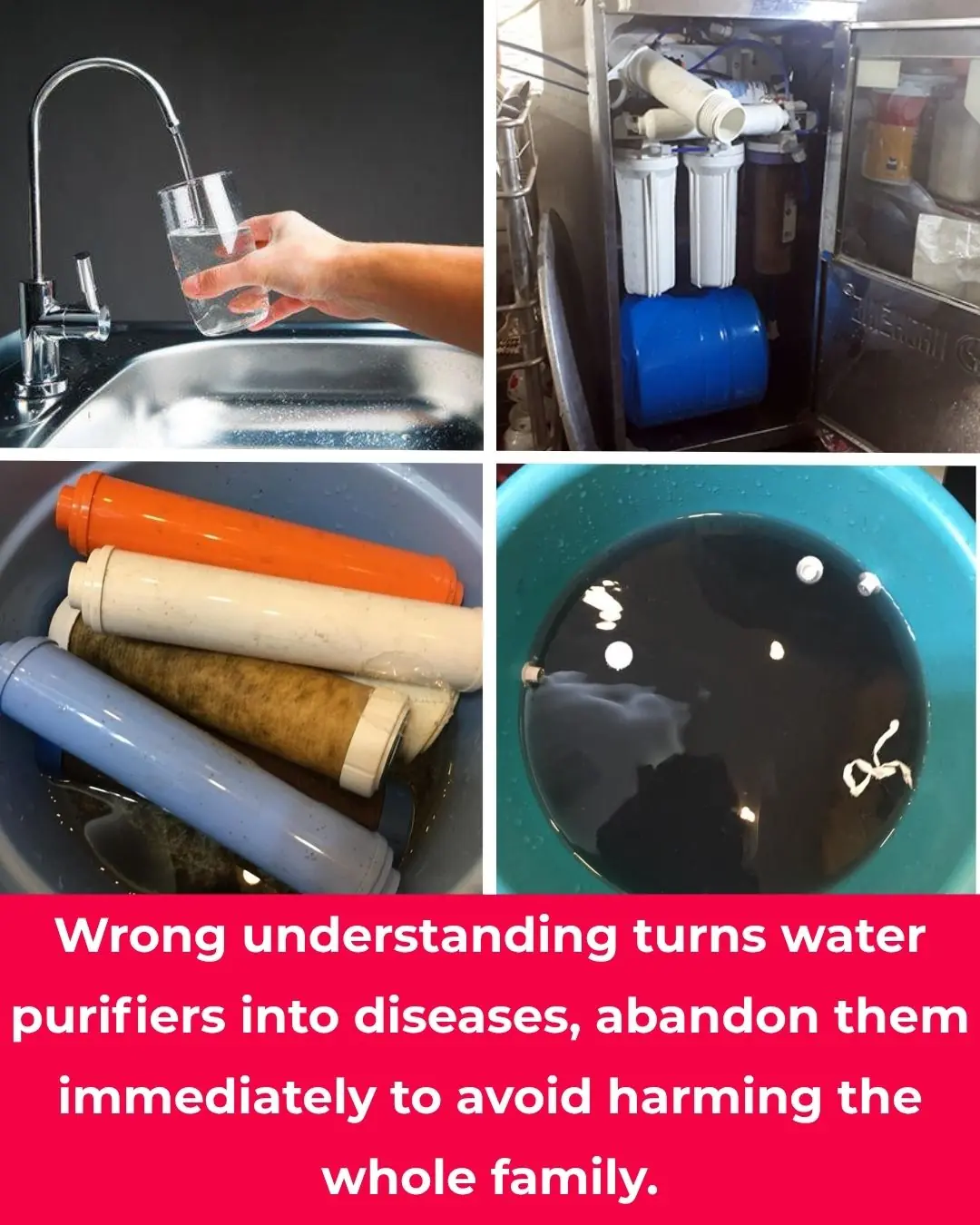

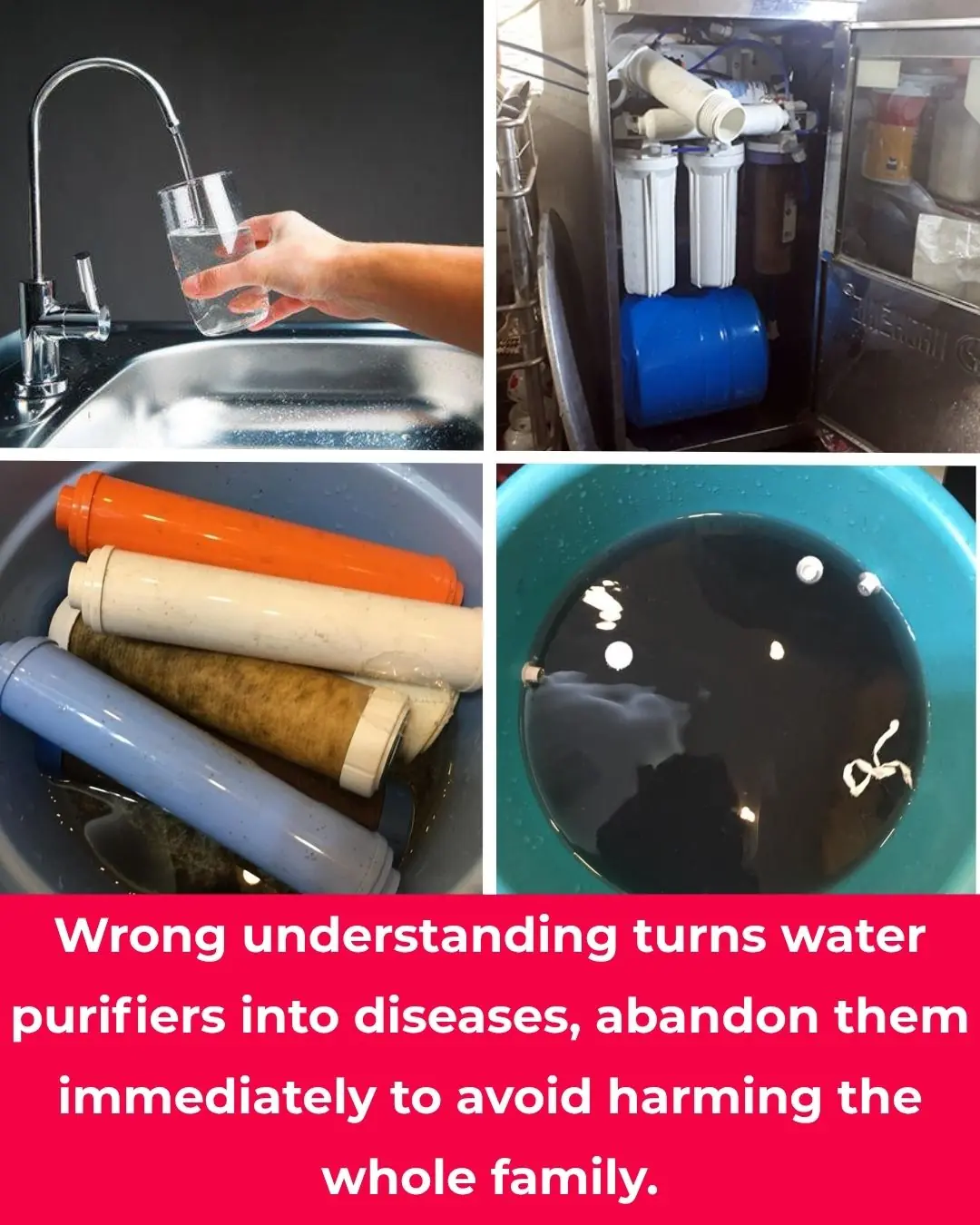

Knowledge of how a water filter can become a disease site

When boiling pork intestines, don't put them in cold water: Doing it this way will make the intestines white and crispy, but not tough.

Bone stew, simmered bones for this dish, the meat is tender and the broth is sweet and clear.

Last weekend, I made grilled ribs like this to treat my guests. Everyone exclaimed because it was so delicious.

When you buy pork, don't wash it in water right away. If you do this, the meat will stay fresh and delicious for a whole month.

Don't put ripe bananas in the refrigerator right away: Do it this way, and they will stay fresh for a whole month, without turning black or spoiling.

Sour star fruit soaked in rock sugar has great effects?

Crush a handful of these leaves and put them in the room

Help! My 8-year-old was bitten by this strange bug, and I’m really worried. My sister-in-law nearby has seen similar ones. Any idea what it is?

You’re doing it all wrong. Here’s the right way to wash pillows

Horse Chestnut: The Strongest Natural Remedy for Swollen Legs and More…

These ideas are brilliant

News Post

7 Affordable Fruits That Are Surprisingly Good for Fatty Liver – Everyone Should Know

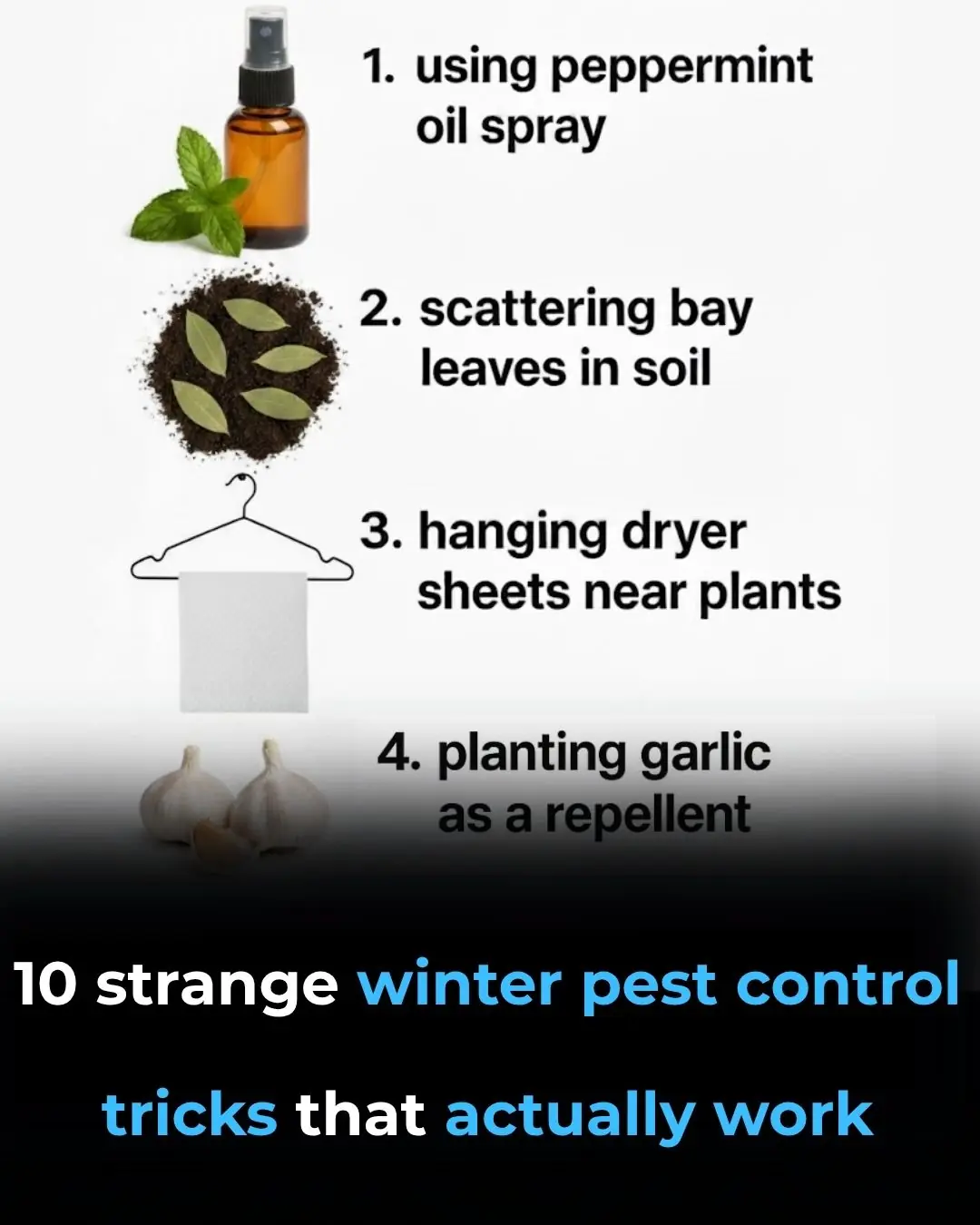

10 Weird Winter Pest Control Tricks That Actually Work

Put Two Glasses on the Door Handle — A Small Action That Brings Big Safety Benefits

Rats Running on the Ceiling? Try These Simple Tricks to Get Rid of Them for Good

How Long Can You Keep Frozen Meat? Here’s the Answer

Drink Coffee at These Four “Golden” Times of Day for Maximum Benefit: Your Liver, Digestion and Whole-Body Health Get a Boost

If you drink lemon water every morning, this is what happens to your body

Simple way to repel cockroaches

Washing Machine Full of Dirt and Bacteria? Pour One Bowl of This Inside — It’ll Be Spotless and Fresh Like New!

Stop cooking these 10 things in the microwave

Stop organizing these 10 things backwards

The Silica Gel Pack You Always Throw Away Has 6 “Magical” Uses: Great for Your Health and Elevates Everyday Life

The Hidden Consequences of a S*xless Life

Put ice cubes in to cook rice: The seeds are delicious and chewy

Knowledge of how a water filter can become a disease site

When boiling pork intestines, don't put them in cold water: Doing it this way will make the intestines white and crispy, but not tough.

Bone stew, simmered bones for this dish, the meat is tender and the broth is sweet and clear.

Last weekend, I made grilled ribs like this to treat my guests. Everyone exclaimed because it was so delicious.